The Australian Dollar[1] is approaching multi-year uptrend support after plummeting nearly 6% off the yearly highs. If the broader uptrend is to remain viable, prices will need to find a low ahead of this key structural support confluence in the days to come. It’s make-or-break here for the Aussie.

AUD/USD Daily Price Chart

Technical Outlook: In this week’s Technical Perspective[2], we noted that the Australian Dollar was, “approached a long-term support confluence we’ve been tracking since the start of the year at 7612/37. This region represents a critical inflection point for price and IF broken would risk a substantial sell-off in the Aussie.” Put simply, price is trading just above major uptrend support and we’re on the lookout for an exhaustion low while above 7612.

New to Forex[3] Trading? Get started with this Free Beginners Guide[4]

AUD/USD 240min Price Chart

Notes: A closer look at price action see’s Aussie trading within the confines of a descending channel formation with the lower parallels further highlighting support into 7612. A near-term embedded channel keeps the focus lower while below the weekly opening-range highs with a breach above 7707 needed to get things going. Such a scenario targets subsequent topside objectives at 7748, 7780 and the 61.8% retracement at 7812. A break / daily close below 7612 would invalidate the reversal play and keep the short-bias in focus targeting 7552 backed by 7501 & the 50% retracement at 7476.

Why does the average trader lose? Avoid these Mistakes in your trading[5]

Bottom line: Be on the lookout for a near-term exhaustion low with 7637 & 7612 both representing key zones of interest. From a trading standpoint, I’ll favor fading weakness into this support confluence with a breach above channel resistance needed to validate a near-term reversal. Ultimately, this is a BIG level for Aussie and a break below could prove terminal to the multi-year uptrend - tread lightly until we get some convincing near-term price action.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy[6]

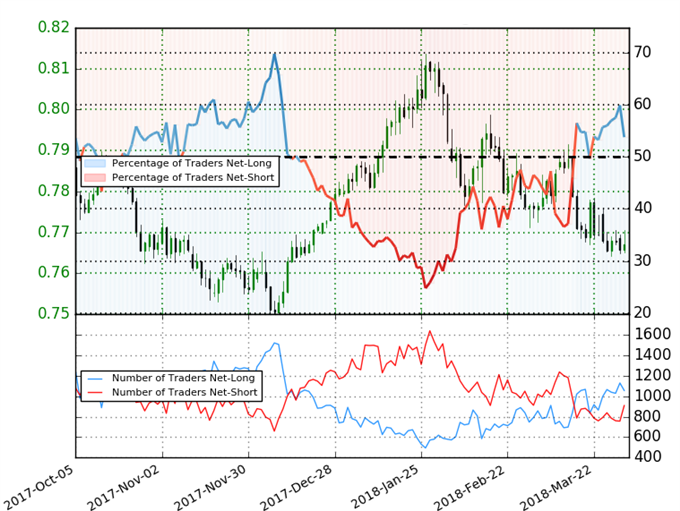

AUD/USD IG Client Positioning

- A summary of IG Client Sentiment[7] shows traders are net-long AUDUSD- the ratio stands at +1.16 (53.8% of traders are long) –weak bearishreading

- Retail has remained net-long since Mar 22nd; price has moved 1.4% lower since then

- Long positions are 4.3% lower than yesterday and 11.2% higher from last week

- Short positions are 13.6% higher than yesterday and 5.1% higher from last week