Talking Points:

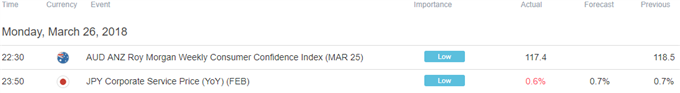

Japanese Yen[1] declines as broad-based market sentiment improves Aussie, Kiwi Dollars lower as markets weigh up Fed rate prospects “Risk-on” bias hinted but headline flow may derail follow-through The Japanese Yen underperformed in Asia Pacific trade, falling against all of its major counterparts as a recovery in risk appetite sent regional bourses higher and undermined support for the standby anti-risk currency. The MSCI Asia Pacific equities benchmark added nearly a full percentage point. Selling pressure may have been compounded by a brighter view of relative Fed policy prospects. The US Dollar[2] crumbled Monday as improving sentiment revived speculation that a broadening global recovery may yet push top central banks to follow the FOMC[3]’s hawkish lead, eroding the greenback’s yield advantage. A more sober interpretation may be emerging. Indeed, if last week’s turmoil was an overreaction, the Fed may find greater room to indulge its seemingly growing appetite for faster tightening. Tellingly, similarly yield-sensitive currencies the Australian and New Zealand Dollars likewise traded broadly lower. Looking ahead, a quiet offering on the economic data front hints that broad-based sentiment trends are likely to remain decisive for G10 FX price action. FTSE 100[4] and S&P 500[5] futures are pointing higher, hinting the path of least resistance favors a “risk-on” bias. That portends deeper Yen losses. Traders would be wise to proceed with caution without presuming follow-through however. News-flow from Washington DC remains a potent source of headline risk and might rapidly alter the prevailing mood, especially amid a lull in top-tier scheduled developments. See our guide to learn how you can use economic news into your FX trading strategy[6]! Asia Pacific Trading Session European Trading Session

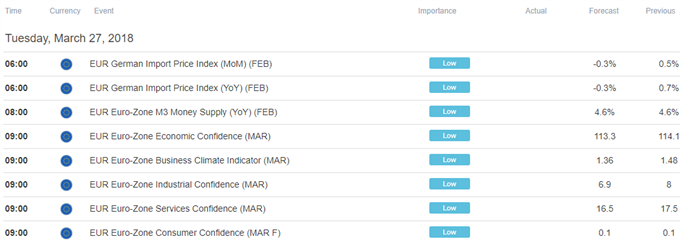

European Trading Session ** All times listed in GMT. See the full economic calendar here[7]. FX TRADING RESOURCES --- Written by Ilya Spivak, Currency Strategist for DailyFX.com To contact Ilya, use the comments section below or @IlyaSpivak[8] on Twitter To receive Ilya's analysis directly via email, please SIGN UP HERE[9]

** All times listed in GMT. See the full economic calendar here[7]. FX TRADING RESOURCES --- Written by Ilya Spivak, Currency Strategist for DailyFX.com To contact Ilya, use the comments section below or @IlyaSpivak[8] on Twitter To receive Ilya's analysis directly via email, please SIGN UP HERE[9]

References

- ^ Japanese Yen (www.dailyfx.com)

- ^ US Dollar (www.dailyfx.com)

- ^ FOMC (www.dailyfx.com)

- ^ FTSE 100 (www.dailyfx.com)

- ^ S&P 500 (www.dailyfx.com)

- ^ use economic news into your FX trading strategy (www.dailyfx.com)

- ^ full economic calendar here (www.dailyfx.com)

- ^ @IlyaSpivak (www.twitter.com)

- ^ SIGN UP HERE (forms.aweber.com)