The Canadian Dollar[1] has finally caught a bid with USD/CAD reversing sharply off key confluence resistance this week. The pair remains vulnerable while below this threshold with the pullback in price now approaching near-term uptrend support-we’re looking for further evidence that a more significant exhaustion high may be in place.

USD/CAD Daily Price Chart

Technical Outlook: USD/CAD turned from a key resistance confluence this week at 1.3103/32- a region where the 100% extension of the September advance and the 61.8% retracement of the 2017 decline converges on the upper median-line parallel of the ascending pitchfork formation[2]. Note that daily RSI marked clear divergence into this high with a support trigger pending.

Near-term support rests with the 2017 January low at 1.2968 with a daily close below needed to suggest that a more significant high may be in place. Such a scenario would target the 2012 trendline which converges on the monthly opening range[3] lows t 1.2803. A topside breach still has to contend with longer-term slope resistance just shy of 1.32.

New to Forex[4] Trading? Get started with this Free Beginners Guide[5]

USD/CAD 240min Price Chart

Notes: A closer look at USD/CAD price action shows the pair trading within the confines of a near-term ascending channel formation extending off the February lows. The near-term focus remains lower while below 1.3132 with subsequent support targets eyed at 1.2918- look for a reaction there. A break keeps the short-bias in play targeting the monthly open at 1.2829 backed closely by 1.2789.

Why does the average trader lose? Avoid these Mistakes in your trading[6]

Bottom line: USD/CAD turned from critical confluence resistance this week and while the immediate focus is lower, we’ll be looking for a break of this bullish formation to validate a larger reversal in price. From a trading standpoint, I’ll favor fading strength while below the upper parallel. Keep in mind that we still have the release of the FOMC[7] interest rate decision later today with Canada CPI on tap on Friday.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy[8]

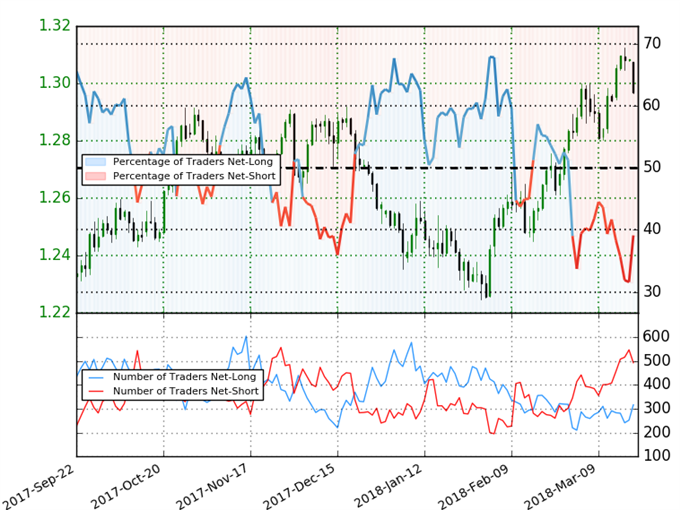

USD/CAD IG Client Sentiment

- A summary of IG Client Sentiment[9] shows traders are net-short USDCAD- the ratio stands at -1.6 (39.1% of traders are long) – weak bullishreading

- Traders have remained net-short since Mar 1st; price has moved 1.0% higher since then

- Long positions are 29.0% higher than yesterday and 6.0% higher from last week

- Short positions are13.8%