Talking Points:

- Euro[1] may fall as ECB President Draghi reiterates dovish policy bias

- EU response to US tariff hike may trigger risk aversion, boosting Yen

- US Dollar[2] at risk if retail sales data leaves Fed outlook at status quo

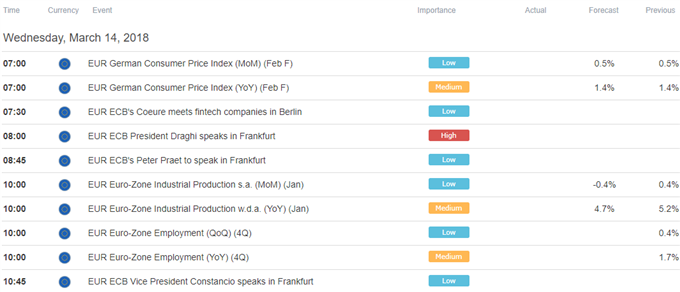

Another quiet day on the European economic data docket puts a speech from ECB President Mario Draghi in focus. He is due to opine at the “ECB and Its Watchers” conference. Comments are also due from the central bank’s Vice President Vitor Constancio, its chief economist Peter Praet, Bank of France Governor Francois Villeroy de Galhau. Separately, Ignazio Angeloni of the ECB Supervisory Board will deliver a speech tellingly titled “Tapering and Final QE:The Effects on Assets Under Management”.

In all, traders will look to the tone of policymakers’ pronouncements to inform bets on the path of the central bank’s asset purchases. The current program – amounting to €30 billion per month – is currently scheduled to run through September. The Euro buckled as last week’s ECB policy call projected a dovish stance[3], hinting officials are in no hurry to tighten. Similar rhetoric this time may revive selling pressure.

Meanwhile, the European Commission – the executive arm of the EU – will comment on last week’s US steel and aluminum tariff increase. While NAFTA countries and Australia scored exemptions, the regional bloc pointedly did not (at least thus far). A defiant response that opens the door for retaliatory measures may spook the markets, offering a lift to the anti-risk Japanese Yen[4] and Swiss Franc[5].

Later in the day, the spotlight turns to February’s US Retail Sales report. An increase of 0.3 percent from the prior month is expected. Data outcomes have broadly stabilized relative to forecasts in recent months, hinting that a wild deviation from them is probably unlikely. This stands to keep Fed policy bets anchored, which has recently translated into US Dollar weakness as traders bet on catch-up from other top central banks.

See our free guide to learn how you can use economic news in your FX trading strategy[6]!

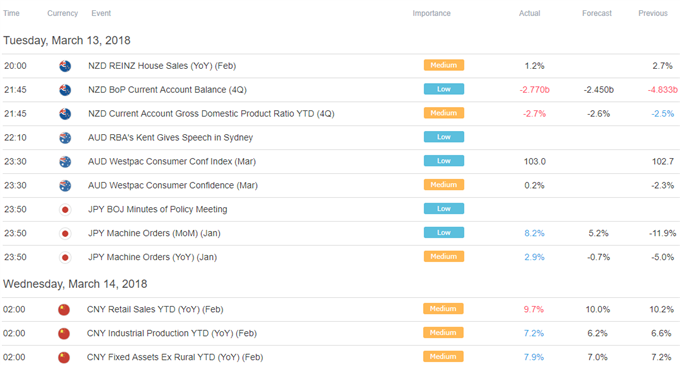

Asia Pacific Trading Session

European Trading Session

** All times listed in GMT. See the full economic calendar here[7].

FX TRADING RESOURCES

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak[8] on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE[9]