AUD/JPY[1] opened the week just above a key support pivot with a rebound in price taking the pair back towards downtrend resistance. The focus is on a break of a near-term range as we look for evidence that a larger recovery may be underway within the context of the broader downtrend.

AUD/JPY Daily Price Chart

Technical Outlook: In this week’s Technical Perspective we noted that AUD/JPY was testing a critical inflection zone[2] at 81.58, “into the weekly open and IF price is going to rebound, this would be a good spot.” Indeed the pair rebounded after testing this key support threshold with the advance turning just ahead of confluence resistance at 83.38. The immediate focus is on a break of range with a breach above the median-line needed to fuel the next leg higher. That said, a break below would keep the broader short-bias in play targeting the sliding parallel (red) and the 61.8% retracement at 80.57.

New to Forex[3] Trading? Get started with this Free Beginners Guide[4]

AUD/JPY 120min Price Chart

Notes: A closer look at AUD/JPY price action highlights a near-term descending pitchfork formation[5] extending off the January highs with the pair rebounding off a sliding parallel (red) extending off the 2/14 low early in the week. The advance encountered resistance at 83.28/38 yesterday- note that this threshold converges on the median-line and a breach / close above would be needed to suggest a more significant near-term low is in place. Such a scenario eyes subsequent topside resistance objectives at 84.25/38 backed by the upper parallel.

Why does the average trader lose? Avoid these Mistakes in your trading[6]

Interim support rests with the 61.8% retracement of the advance at 82.19 with a break below 81.58 needed to put the bears back in control targeting 80.57/68. Bottom line: We’re looking for evidence that a near-term low is in place and on the back of what looks like a clear five-wave advance off the lows, we’ll favor fading weakness while above 81.58.

From a trading standpoint, I’ll be looking for a pullback here to offer favorable entries targeting a break higher. Ultimately, we’d be looking to sell a larger rally up towards the upper bounds of this formation. Keep in mind we still have the release of the Bank of Japan (BoJ) interest rate decision on Friday.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy[7].

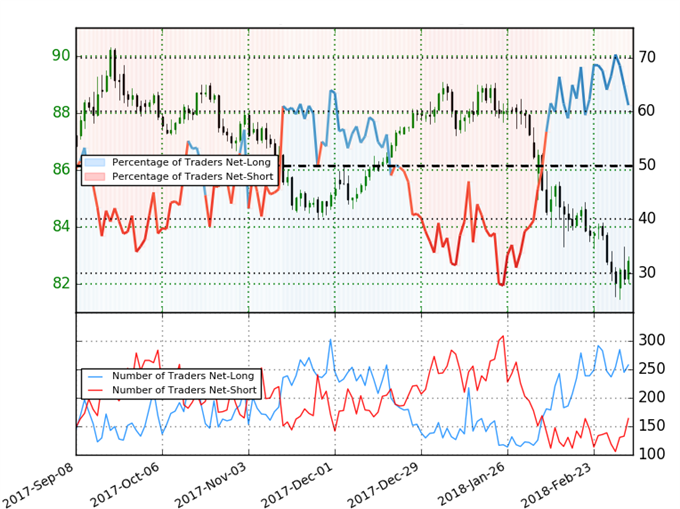

AUD/JPY IG Client Sentiment

- A summary of IG Client Sentiment[8] shows traders are net-long AUDJPY- the ratio stands at +1.57 (61.1% of traders