EUR/USD, Euro Talking Points:

EUR/USD Returns to Key Support

The Q3 open has so far seen a return of sellers in EUR/USD[1], following a month of June that saw bears get squeezed as US Dollar weakness had showed up. Behind that USD[2] weakness was a seemingly dovish outlay at the Federal Reserve in which the bank highlighted the prospect of a rate cut in the second-half of this year. But, as that dovish scenario was getting priced-in to markets through the both bonds and the US Dollar[3], stocks continued to rally, eventually pushing up to fresh all-time-highs. And then all-of-the-sudden, that dovish backdrop around the Fed didn’t look as probable as it did around the June open.

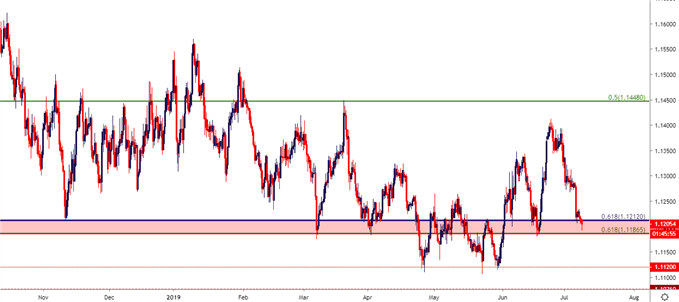

At this point, USD strength has been consistently showing since the July open, and this week will see the currency stay on center-stage as a series of Fed speeches populate the calendar[4], highlighted by the two-day testimony from FOMC Chair Jerome Powell on Capitol Hill. That takes place on Wednesday and Thursday and leading into that event, EUR/USD[5] is sitting at an area of support that’s been in-play in various fashions since last November. This zone runs from the 1.1187 Fibonacci level[6] up to the 1.1212 level, the latter of which is the 61.8% retracement of the ‘lifetime move’ in EUR/USD.

This zone was last in-play on the pair around the June FOMC rate decision[7], helping to set the mid-month swing low ahead of EUR/USD pushing up to fresh two-month-highs.

EUR/USD Eight-Hour Price Chart

Chart prepared by James Stanley[8]