Stock Market Fund Flows Talking Points:

- Broad-market ETFs SPY, IVV and VOO notched $4.5 billion in outflows for the week

- The XLV healthcare ETF recorded a near-record intraday inflow as the S&P 500[1] began its retreat

- See Q1’19 forecasts for the Dow[2], Dollar, Bitcoin[3] and more with the DailyFX Trading Guides[4].

Stock Market Fund Flows: S&P 500 Retreat Sparks Demand for Defensives

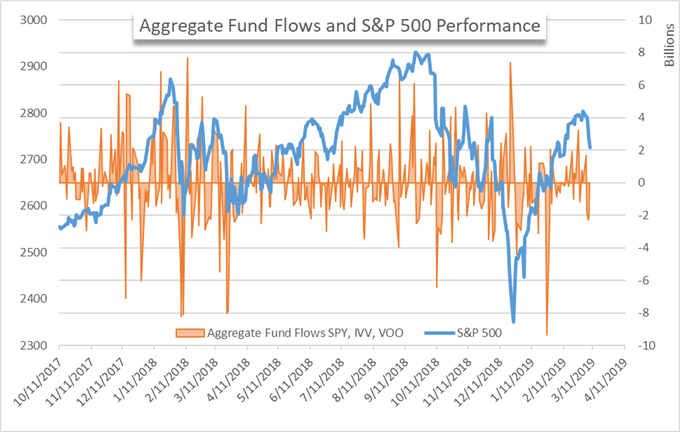

Amid a tumultuous week for the S&P 500 and other US equity markets, fund flows reveal that investors reduced exposure to the broad-market tracking ETFs of SPY, IVV and VOO. Together, the three funds notched $4.5 billion in outflows which marks the first week of net outflows in a month. The week also stands as the fifth week of net outflows for the year to date, despite a simultaneous 8.65% gain for the S&P 500.

Aggregate Fund Flows for Broad Market ETFs versus S&P 500 (Chart 1)

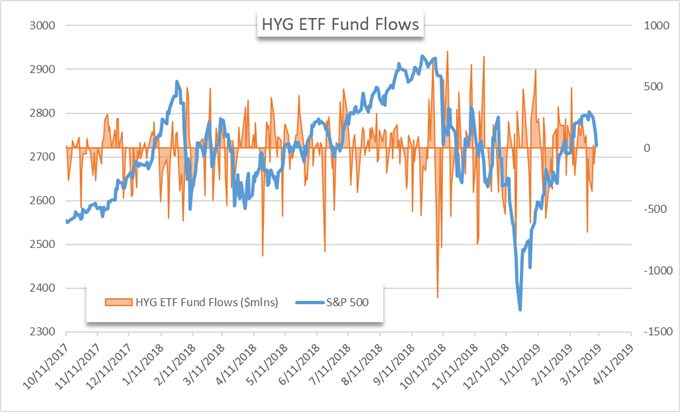

High-Yield Corporate Debt Sees Capital Flight

A sector-specific look into fund flows showed investors were eager to ditch their exposure to high-yield corporate debt, a recent high-flyer in the ETF space. This week however, the HYG ETF saw $108 million exit the fund. While somewhat minor, the week of net outflows marks the second such week after the fund saw its largest intraday outflow in over two months last Wednesday. Prior to the late-February outflows, the fund enjoyed a month of consecutive inflows.

HYG ETF Fund Flows (Chart 2)

Learn tips and tricks to day trading the S&P 500[5]

Defensive Sectors Gain Traction

While broad-market and high-growth ETFs saw capital shift elsewhere, the defensive healthcare sector posted