Fundamental Forecast for the Euro: Neutral

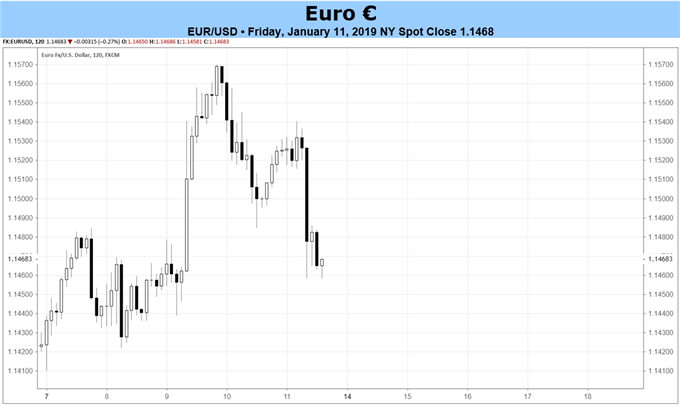

- The first full week of 2019 was rather quiet for the Euro[1]; no cross finished the week more than +/- 0.83% from where it started.

- Upcoming inflation figures suggest that the ECB may have to use its January policy meeting to underscore its commitment to its ultra-loose monetary policy stance.

- The IG Client Sentiment Index[2]shows that traders have trimmed their net-long EUR/USD[3] positions in a minor fashion over the past week.

See our long-term forecasts for the Euro and other major currencies with the DailyFX Trading Guides[4].

The Euro had a middling first full week of 2019, gaining against three currencies while losing ground against four others. The biggest loser, EUR/NZD[5], was only down by -0.83%, while the top performing cross, EUR/USD, added a mere +0.65%. Absent meaningful data on the economic calendar, the Euro was largely left to the machinations of the other major currencies and developments along their own fault lines: the US government shutdown; the US-China trade war; Brexit; and rising geopolitical tensions in the Syria theater.

Inflation Remains Constrained After Energy Price Decline

The coming week, however, should provide information that will have a direct influence over the EUR-complex. Thursday’s December Eurozone CPI report is the final significant data release before the January European Central Bank Policy meeting (January 24), and the data may provide cover for the ECB to shift its forward guidance (and therefore, rate hike timing) in a more dovish direction.

Even though energy prices have stabilized over the past month – Brent Oil[6] closed this week at $60.59/brl, up from