Trading the News: U.S. ISM Manufacturing

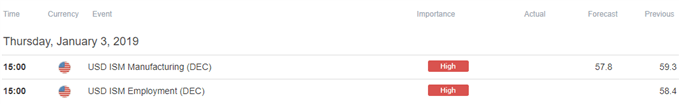

Fresh updates to the ISM Manufacturing survey may fuel a larger rebound in EUR/USD[1] as the index is expected to narrow to 57.8 from 59.3 in November.

Signs of waning business confidence may drag on the U.S. dollar[2] as it curbs bets for an imminent Federal Reserve rate-hike, and the central bank may largely endorse a wait-and-see approach at its next interest rate decision on January 30 as officials ‘see growth moderating ahead.’

As a result, a marked downtick in the ISM Manufacturing survey may produce headwinds for the U.S. dollar as it dampens the outlook for growth and inflation, but another unexpected improvement in business sentiment may foster a bullish reaction in the greenback as it puts pressure on the FOMC[3] to further embark on its hiking-cycle. Sign up and join DailyFX Currency Analyst David Song LIVE[4] for an opportunity to discuss potential trade setups.

Impact that the ISM Manufacturing survey has had on EUR/USD during the previous print

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

NOV 2018 |

12/03/2018 15:00:00 GMT |

57.5 |

59.3 |

+8 |

+5 |

November 2018 U.S. ISM Manufacturing

EUR/USD 5-Minute Chart

The ISM Manufacturing survey unexpectedly improved