Japanese Yen Talking Points

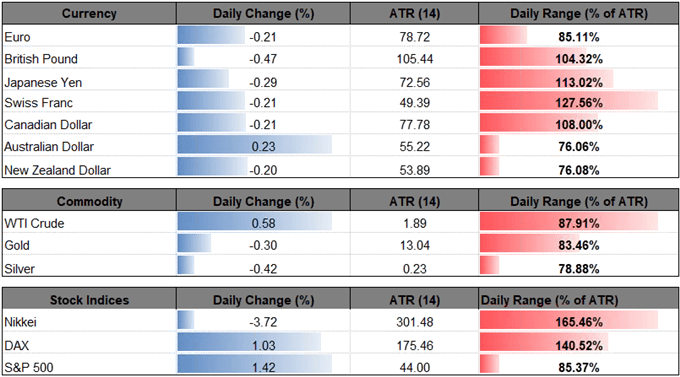

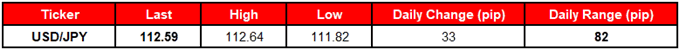

USD/JPY[1] bounces back from a fresh weekly-low (111.82), with benchmark equity indices reflecting a similar dynamic, but the exchange rate may continue to threaten the upward trend from earlier this year as it extends the series of lower highs from earlier this week.

USD/JPY Bull Trend Vulnerable to Swing in Risk Sentiment

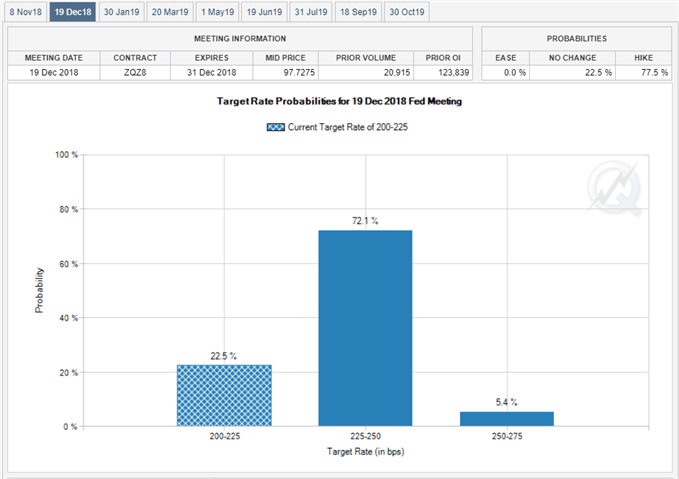

It seems as though swing in risk appetite will continue to sway USD/JPY ahead of the next Federal Open Market Committee[2] (FOMC) meeting in November as the central bank is widely expected to retain the current policy, and the recent pickup in risk appetite may prove to be short lived as dual threats of rising tariffs, rates add to the global wall of worry[3].

Keep in mind, the FOMC’s hiking-cycle instills a long-term bullish outlook for USD/JPY as Chairman Jerome Powell & Co. appear to be on track to deliver another 25bp rate-hike in December, and the central bank may continue to endorse a hawkish forward-guidance going into 2019 as a growing number of Fed officials see a risk for above-neutral interest rates.

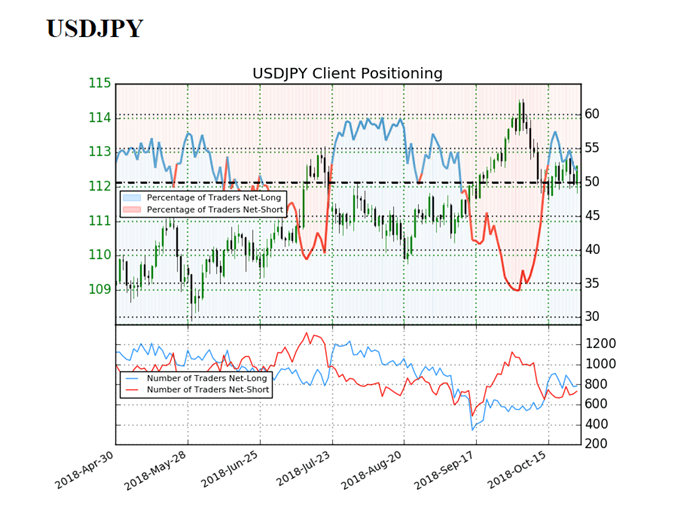

Until then, USD/JPY remains susceptible to a larger correction as there appears to be a material change in market behavior, and a pickup in volatility may continue to impact retail interest as traders appear to be positioning for a near-term advance in the exchange rate.

The IG Client Sentiment Report[4]shows 53.2% of traders are net-long with the ratio of traders long to short at 1.14 to 1. Even though the number of traders net-long is 2.4% lower than yesterday and 8.6% lower from last week, with the number