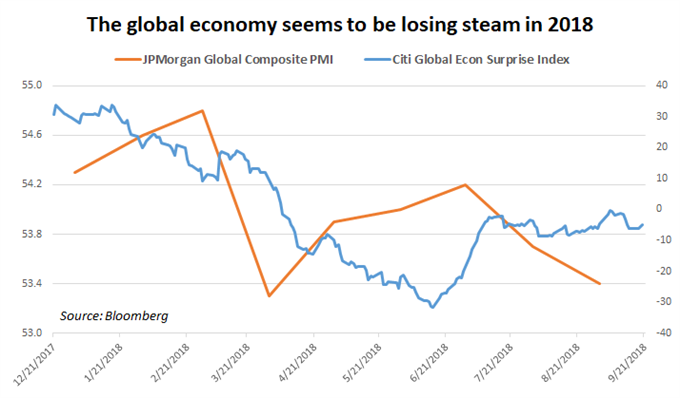

Global share prices accelerated upward in the third quarter, building on the rebound started in the preceding three months. The benchmark MSCI World stock index is on pace to add 5-6 percent for the period. That such performance can be had against a backdrop of a deepening trade war between the US and China as well as increasing emerging market instability is almost improbably impressive. One might conclude perseverance against such odds speaks to hearty underlying strength, making continuation likely. Still, critical vulnerabilities are much too glaring to ignore; the global economy has decelerated in 2018.

The Global Economy Seems to be Losing Steam in 2018 (Chart 1)

Heading into the end of the year, upside resolve may be put to the test for the US S&P 500[1]; but until we see big levels break on the downside, the trend for U.S. stocks will remain pointed higher. In terms of the German DAX 30[2], heading into the previous quarter, we said that a broad head-and-shoulders pattern, with its beginnings dating back over a year, could come into play. Another three months later and the index is flirting with this scenario becoming a reality. The UK FTSE 100[3] is on similar footing as its German counterpart. After several months of sideways trading the Japanese Nikkei 225[4] is sitting with better posturing than both the DAX and FTSE, but is still lagging behind the S&P 500.

Check out other fourth quarter forecasts and the full equity forecast here.[5]

--- Written by Ilya Spivak, Senior Strategist, and Paul Robinson, Market Analyst