Fundamental Forecast for EUR/USD: Neutral

- The Euro’s decline mid-week began after the release of the Q2’18 Eurozone GDP report, which showed growth was slower than anticipated – with traders speculating that the ECB will be slow to tighten monetary policy.

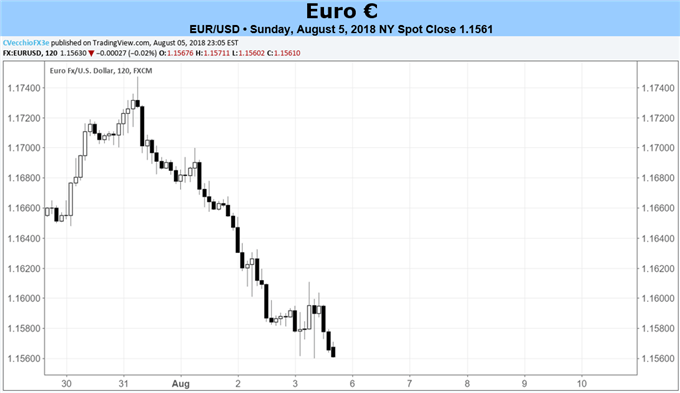

- EUR/USD’s losses were consistent through the end of the week, but for now the 1.1510-1.1853 range since the middle of June remains in place.

- The IG Client Sentiment Index[1] is now issuing a bearish bias for EUR/USD[2].

See our long-term forecasts for the Euro[3] and other major currencies with the DailyFX Trading Guides[4].

The Euro was the second worst performing currency last week, barely edging out the British Pound[5] (EUR/GBP +0.03%). Losses were consistently modest elsewhere, with only one pair declining by more than -1% (EUR/CAD -1.27%). But the catalyst for the declines were endogenous to the Euro, with the Q2’18 Eurozone GDP report coming in weaker than anticipated (+2.1% versus +2.4% annualized), affirming the path of a slow withdrawal of monetary stimulus by the European Central Bank over the next year.

Unfortunately for the Euro, there’s not much for traders to hang their hats on in order to spark a turnaround in the EUR-spectrum. The economic calendar over the coming week features zero ‘high’ rated events, and the most important data release is either the June German Factory Orders report (Monday) or the June German Industrial Production report (Tuesday), neither of which has the cachet to move the needle in a meaningful way for the Euro.

Nor will the central bank speech circuit provide a catalyst: none of the top EB policymakers are