Trading the News: Federal Open Market Committee (FOMC) Interest Rate Decision

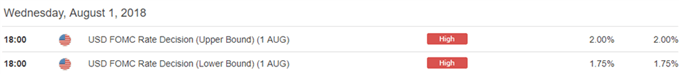

The Federal Reserve interest rate decision may spark a limited reaction as the central bank is widely expected to keep the benchmark rate on hold, but a shift in the forward-guidance for monetary policy may alter the near-term outlook for EUR/USD[1] as Fed officials stick to the hiking-cycle.

Fresh comments from Fed officials may heighten the appeal of the U.S. dollar[2] as the central bank appears to be on track to further normalize monetary policy, and Chairman Jerome Powell & Co. may ultimately prepare U.S. households and businesses for an imminent rate-hike as ‘the FOMC[3] believes that--for now--the best way forward is to keep gradually raising the federal funds rate.’

As a result, a batch of hawkish Fed rhetoric may weigh on EUR/USD, but more of the same from the central bank may produce headwinds for the U.S. dollar as it dampens bets for four Fed rate-hikes in 2018.Sign up and joinDailyFX Chief Strategist John Kicklighter LIVE[4] to cover the FOMC interest rate decision.

Impact that the Fed rate decision has had on EUR/USD during the previous meeting

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

JUN 2018 |

06/13/2018 18:00:00 GMT |

1.75% to 2.00% |

1.75% to 2.00% |

+1 |