Trading the News: U.S. Consumer Price Index (CPI)

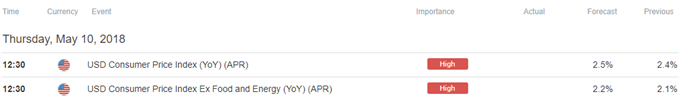

- U.S. Consumer Price Index (CPI) to Pick Up for Third Straight Month in April. Core Rate to Increase to Annualized 2.2% from 2.1%.

- EUR/USD[1] Preserves Bearish Sequence, Relative Strength Index (RSI) Sits in Oversold Territory.

Another pick up in the headline and core U.S. Consumer Price Index (CPI) may fuel the recent decline in EUR/USD as it puts pressure on the Federal Open Market Committee[2] (FOMC) to adopt a more aggressive approach in normalizing monetary policy.

Signs of above-target price growth may push Chairman Jerome Powell and Co. to adjust the dot-plotat the next interest rate decision on June 13 as ‘the Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate,’ and the committee may show a greater willingness to extend the hiking-cycle as the central bank largely achieves its dual mandate.

However, a series of below-forecast prints may generate a rebound in the euro-dollar rate as it saps bets for four rate-hikes in 2018, and Fed officials may continue to project a terminal benchmark interest rate of 2.75% to 3.00% as ‘the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.Sign up and join DailyFX Currency Analyst David Song LIVE[3] to cover the CPI report.

Impact that the U.S. CPI report has had on EUR/USD during the last print

|

Period |

Data Released |

Estimate |

Actual |

Pips Change |