FX TALKING POINTS:

- Crude Oil[1] Prices to Stay Bid as Bullish Sequence Unfolds. Looking to Relative Strength Index (RSI) for Confirmation.

- USD/JPY Risks Range-Bound Conditions Ahead of U.S. Consumer Price Index (CPI) as Bearish Formation Snaps.

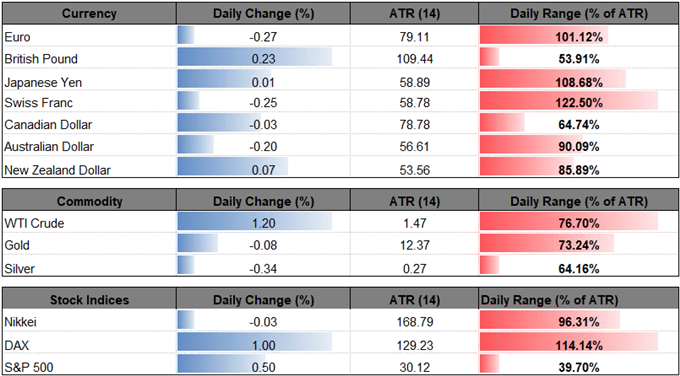

Crude trades above $70/bbl for the first time since 2014, with oil prices at risk of extending the advance from earlier this month as a bullish sequence unfolds. Meanwhile, the U.S. dollar[2] regains its footing following the lackluster Non-Farm Payrolls (NFP) report,

CRUDE OIL PRICES TO STAY BID AS BULLISH SEQUENCE UNFOLDS

Crude remains bid as U.S. President Donald Trumpthreatens to withdraw from the 2015 Iran nuclear deal, and oil prices may continue to retrace the decline from back in 2014 as they breakout of a near-term range.

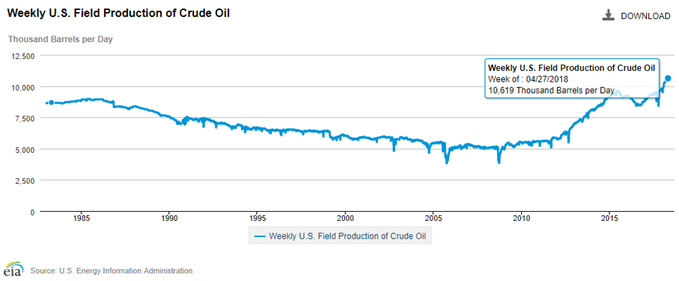

Even though U.S. field outputs sit at record-highs, renewed sanctions against Iran may keep oil prices afloat especially as the Organization of the Petroleum Exporting Countries (OPEC) and its allies keep the door open to carry the production-cutting pact into 2019. In turn, officials in Saudi Arabia may largely achieve their target of $80/bbl over the coming months, with increased turmoil in the Middle East likely to fuel the recent rally as both price and the Relative Strength Index (RSI) preserve the bullish trends from earlier this year.

Bear in mind, recent price action warns of extreme market conditions as the RSI approaches 70, and oil prices may exhibit a similar behavior as the start of 2018 should the oscillator push into overbought territory.

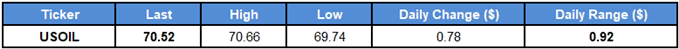

USOIL DAILY CHART

- Recent series of higher highs & lows keeps the topside targets on the radar, with a break/close above $71.30 (38.2% expansion)