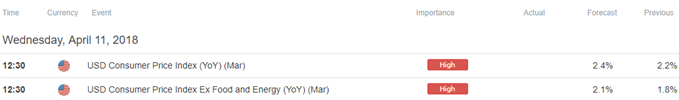

- U.S. Consumer Price Index (CPI) to Increase Annualized 2.4% in March. Core Rate of Inflation to Expand 2.1% per Annum After Rising 1.8% the Month Prior.

- EUR/USD[1] Preserves Bullish Sequence. Outlook Mired by 2018-Range.

Trading the News: U.S. Consumer Price Index (CPI)

Updates to the Consumer Price Index (CPI) may heighten the appeal of the U.S. dollar[2] as both the headline and core rate of inflation are expected to exceed 2% in March.

A material pickup in the CPI may fuel bets for four Fed rate-hikes in 2018 as Chairman Jerome Powell and Co. prepare households and businesses for higher borrowing-costs, and the Federal Open Market Committee[3] (FOMC) may relay a more hawkish tone at the next interest rate decision on May 2 as price growth exceeds the 2% target.

However, a batch of lackluster data prints may produce a bearish reaction in the U.S. dollar as it curbs bets for an extending hiking-cycle, and the central bank may continue to project a neutral Fed Funds rate of 2.75% to 3.00% as the outlook for inflation remains subdued.

Impact that the U.S. CPI report has had on EUR/USD during the previous release

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

FEB 2018 |

03/13/2018 12:30:00 GMT |

2.2% |

2.2% |

|