The draft-law “On digital financial assets” aimed at regulating crypto-related matters in Russia has been officially filed in the State Duma on Tuesday. Disagreements between the Central Bank and the Ministry of Finance have been resolved, according to Deputy Finance Minister Alexei Moiseev. The CBR will have the final say in regards to the circulation of cryptos in the Russian Federation.

Also read: Lawsuit Challenges Google’s Ban on Crypto Ads in Russia

The Law Regulates ICOs and Crypto Mining

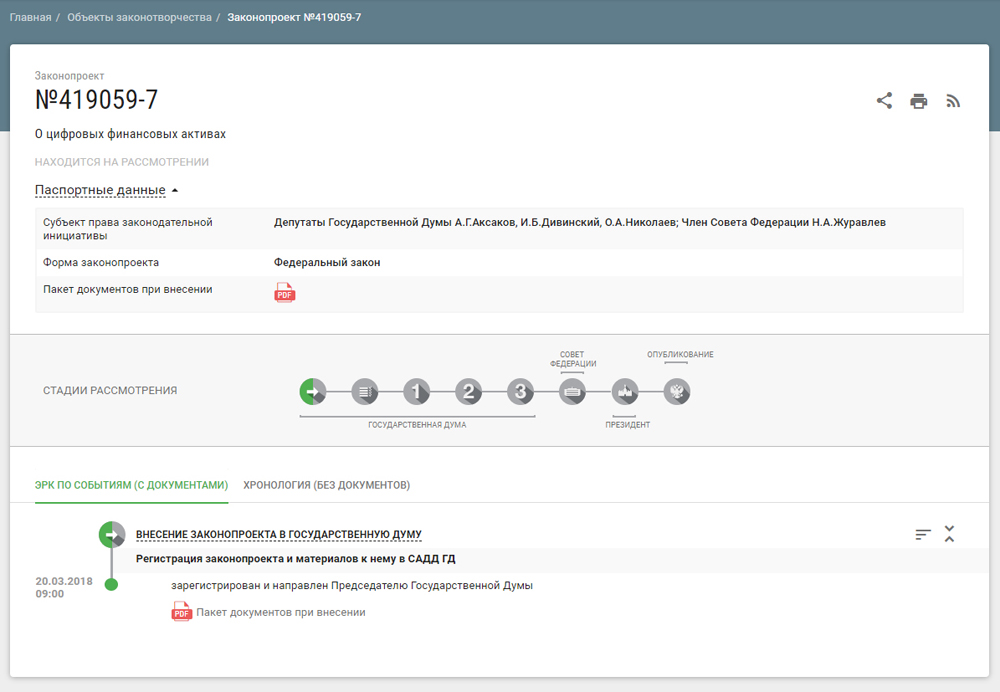

The bill expected to regulate cryptocurrencies, initial coin offerings and crypto mining, has been introduced in the lower house of Russia’s parliament. The official website of the State Duma shows draft №419059-7 has been filed on Tuesday, March 20. The news comes right after Russians gave Vladimir Putin his fourth term in the Kremlin on Sunday. Preliminary results show the President has received more than 76% of the vote.

The draft law “On digital financial assets” defines the legality of “the most widely spread financial assets, currently created and/or issued using digital financial technologies”, according to the explanatory note. It clearly states that the bill covers the implementation of “distributed ledger of digital transactions”. The new legislation also creates “conditions for attracting investments by Russian legal entities and individual entrepreneurs through issuing tokens”. Tokens are described as a “type of digital financial asset”.

The bill also sets the legal basis for conducting ICOs. It establishes the sequence of actions to follow a strict procedure for issuing tokens, RNS reports. The draft states that the release of tokens should be carried out through a public offer. If deputies adopt it in its current version, private individuals and legal entities conducting token sales will be required to disclose specified information about their ICOs.

The authors have included a clause to protect what they call “unqualified investors”. The Central Bank of Russia will have the authority to limit the amount of tokens such individuals can acquire. Initial reports suggested these investments would be capped at 50,000 Russian rubles (~$850 USD). A working group at the Ministry of Economic Development has proposed a 10-fold increase of the limit to 500,000 rubles ($8,500).

Bill 419059-7 gives legal definition to cryptocurrency mining. It has been referred to as a “business activity aimed at creating cryptocurrency and/or validation [of crypto transactions] in order to receive a fee in the form of cryptocurrency”. Other crypto-related terms, like smart contracts, have also been described in the draft.

The Central Bank to Decide the Fate of Bitcoin in Russia

A day before the Law “On digital financial assets” was introduced in the Duma, news came out that a major hurdle in the institutional debate on cryptocurrencies had been overcome. Disagreements between the Central Bank of Russia and the Ministry of Finance have been resolved, Deputy Finance Minister Alexei Moiseev confirmed. It has been decided