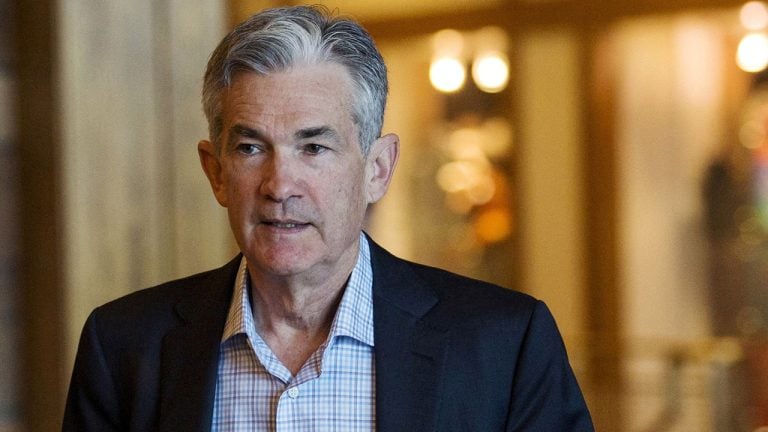

On Friday, Jerome Powell spoke at the annual Jackson Hole Economic Symposium and the Federal Reserve chair explained that the U.S. central bank is focused on fighting the country’s red-hot inflation. Powell stressed at the event that strict monetary policy is necessary, and his commentary hinted that the Fed won’t hit the brakes on monetary tightening until inflation is tamed.

Fed Chair Jerome Powell Says US Central Bank’s Inflation Policy Could Bring ‘Some Pain to Households and Businesses’

Jerome Powell had a lot to say on Friday while the Fed’s chief spoke for ten minutes at this year’s Jackson Hole Economic Symposium hosted by the Federal Reserve Bank of Kansas City. The event dubbed “Reassessing Constraints on the Economy and Policy” featured a number of the world’s central bank officials and policymakers.

Powell discussed inflation in the U.S. and he noted that doing away with the country’s price volatility will take “some time.” Powell further warned that the Fed’s battle with inflation will bring “some pain to households and businesses.” Despite the pain, Powell insisted that it was the “unfortunate costs of reducing inflation.” The 16th chair of the Federal Reserve added:

But a failure to restore price stability would mean far greater pain.

The statements did not sit well with Wall Street investors and the Dow Jones dropped 3% on Friday, recording the worst day the Dow has seen since May. Tech stocks stemming from the Nasdaq composite finished down 4% at the closing bell. Cryptocurrency markets shed 6.1% in 24 hours, and gold and silver also took percentage losses during Friday’s trading sessions as well. During the speech, Powell opined that higher interest rates will slow growth and that “softer labor market conditions will bring down