Dilution-proof, October 1st, 2021

Cycling On-Chain is a monthly column that uses on-chain and price-related data to better understand recent bitcoin market movements and estimate where we are in the cycle. This fifth edition first takes a brief look at factors that provided a headwind for the bitcoin price during September. We then zoom in on an array of on-chain metrics that saw a significant trend change around the January local bitcoin price top, which in hindsight also set a floor price for the recent downturn in the bitcoin market. This column closes off by reflecting on Bitcoin’s current on-chain supply dynamics and macro context.

September Headwinds

After two consecutive months of positive returns on bitcoin during the summer, September provided several headwinds that caused bitcoin’s price trend to mostly move downwards.

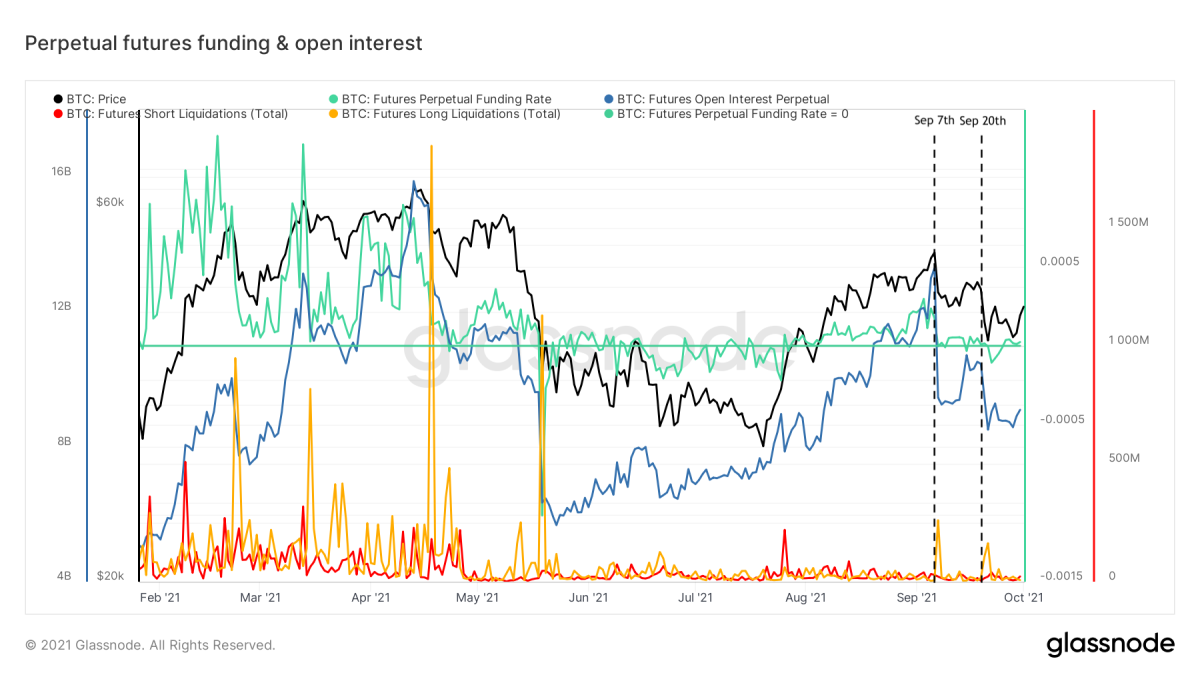

After an initial price increase at the start of the month based on positive market vibes related to El Salvador formally adopting bitcoin as legal tender, price crashed hard on “Bitcoin Day,” September 7, when the law went live. The intraday price range that day was -$10,352 (-19.56%), a steep decline that was partially caused by a domino effect of long liquidations that each triggered another forced sell-off that pushed the price down further, liquidating even more long positions. As can be seen in Figure 1, the funding rates (green) on September 7 weren’t as high as they had been in Q1 when market euphoria was still in full effect. However, open interest (blue) had increased quite a bit over the previous weeks and saw a steep drop due to the forced unwinding of over-leveraged longs.

That event surely scared