Under three months after the Chinese state council banned bitcoin mining, hashrate has been picking up momentum with a V-shape recovery.

Under three months after the Chinese state council banned bitcoin mining, hashrate has been picking up momentum with a V-shape recovery.

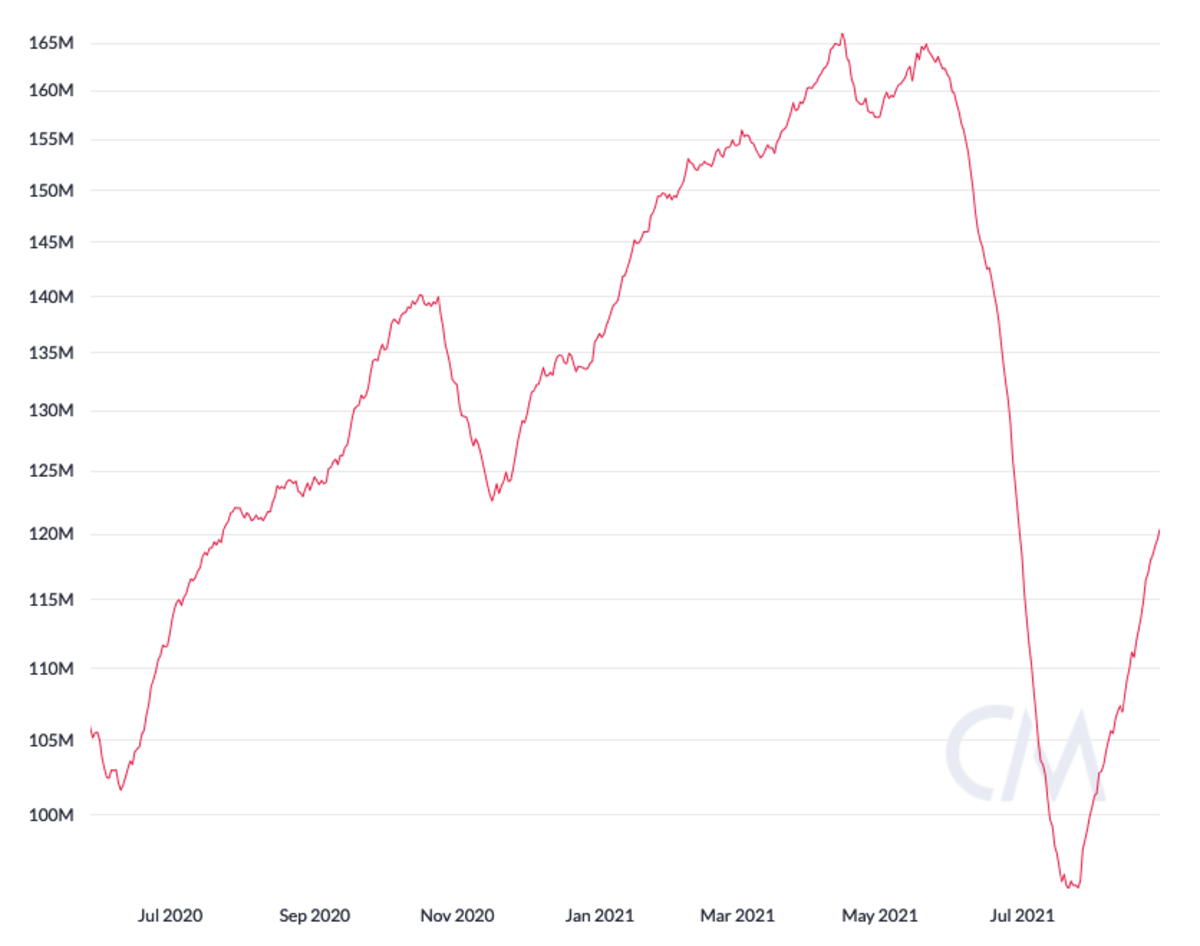

The Bitcoin network's one-month implied hashrate saw almost four months of steady increases since the beginning of 2021, topping at 166 exahashes per second (EH/s) in April. Throughout that month and the next, it lateralized but started dropping sharply as June began. By July 1, the Bitcoin network hashrate had fallen by nearly 30%, bottoming later that month at around 95 EH/s. But since then, hashrate has been recovering quickly, increasing by over 30% in about 30 days and setting a V-shape recovery in motion.

The thriving computing power employed on the Bitcoin network started hovering down as China began tightening bitcoin mining regulations in May[2]. In under two months, provincial governments had already issued plenty of shutdown orders[3] and inspection notices[4] to local miners, who saw no other option than to flee the country for good. But since the great ASIC exodus[5] ensued, some farms started being redeployed overseas[6], bringing all those banned miners back online and triggering a strong hashrate recovery.

August has been a vital month for the Bitcoin network hashrate, with the 30-day moving average of the mean hashrate currently at 120 EH/s, according to CoinMetrics data[7]. The "one-month implied hashrate is a better suited metric to track mid-to-long-term changes in Bitcoin's hashrate because it filters out all of the noise," explained[8] Lucas Nuzzi in his