The amount of bitcoin held by companies worldwide only increases, accounting for nearly 8% of the total 21 million hard cap supply.

The amount of bitcoin held by companies worldwide only increases, accounting for nearly 8% of the total 21 million hard cap supply.

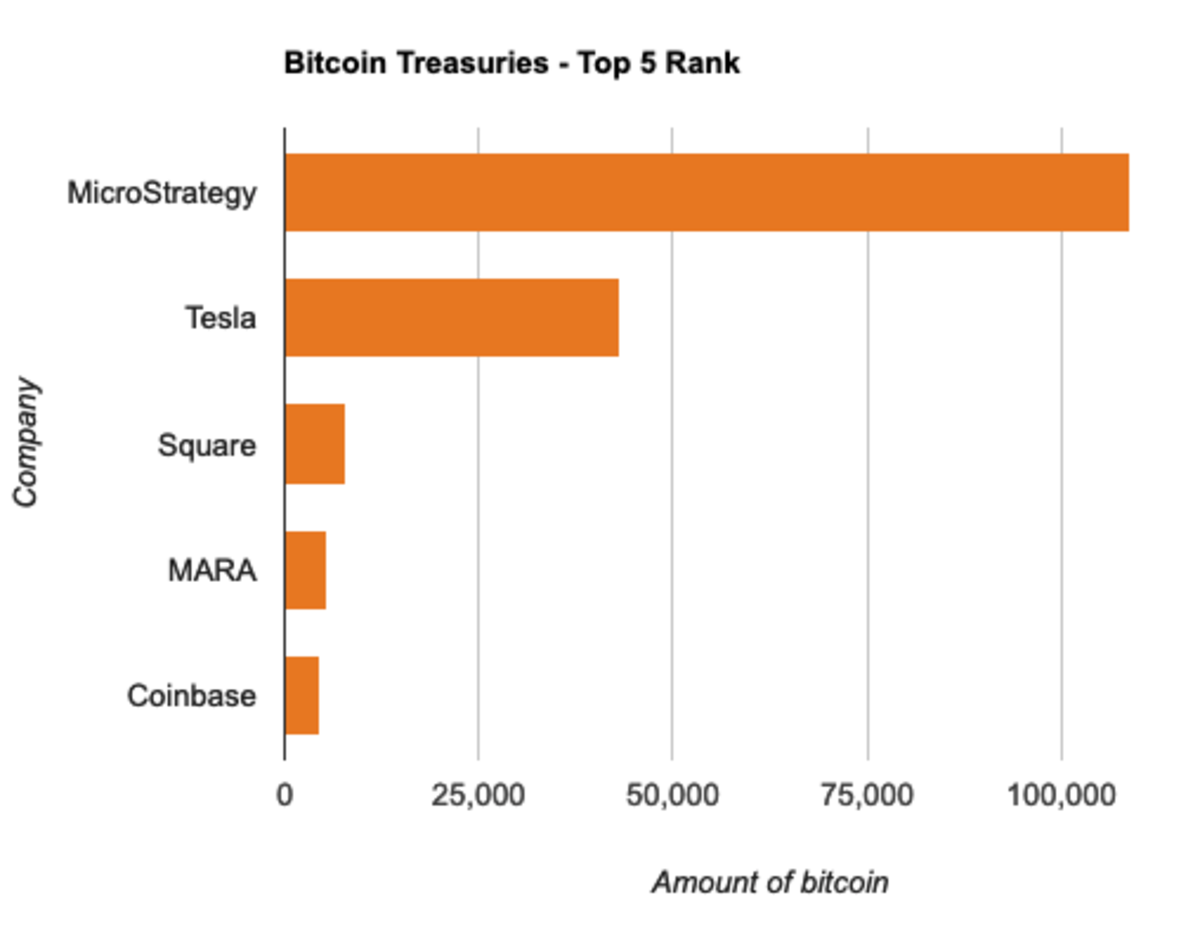

Companies with bitcoin on their balance sheets now hold 1,660,473 BTC, almost 8% of the total bitcoin supply, according to data from Bitcoin Treasuries[2]. MicroStrategy leads the way with 108,991 bitcoin being held, around half percent of the total supply, representing a whopping 75% of the software intelligence company's total market capitalization.

Tesla sits in second place, still holding the 43,200 bitcoin it acquired at the beginning of 2021. The electric car maker is followed by Square, Marathon Digital Holdings, and Coinbase. The fintech payment solutions firm holds a little over eight thousand BTC, whereas the bitcoin miner MARA has allocated 5,425 bitcoin to its balance sheet. Coinbase, the largest U.S. exchange, closes up the top five with a shy 4,487 bitcoin bag[3].

Michael Saylor's MicroStrategy is the publicly traded company with the highest bitcoin allocation, both in absolute terms and relative to its market cap. The software intelligence firm, which yesterday purchased an additional 3,907 bitcoin for $177 million in cash[4], has been leading the way in the corporate world with the simplest yet most effective pair of strategies – DCA[5] and HODL[6]. The firm's current bitcoin bag of 108,991 BTC, which cost nearly $3 billion at the time of purchase, is now worth well over $5 billion and represents 75% of its total market capitalization, currently at $7.12 billion[7]. MicroStrategy's bitcoin holdings have increased