Chainalysis found that bitcoin usage surged in developing countries as citizens seek shelter from currency debasement.

Chainalysis found that bitcoin usage surged in developing countries as citizens seek shelter from currency debasement.

Global adoption of bitcoin and cryptocurrency has skyrocketed in one year, up over 880%, new Chainalysis data found[2]. The company's Global Crypto Adoption Index was released yesterday with data from July 2020 to June 2021 to show how active countries worldwide are in Bitcoin.

The index weighs the data to prevent it from skewing to favor developed countries with large transaction volumes from professional and institutional players. Instead, the goal is to "highlight the countries with the greatest cryptocurrency adoption by ordinary people, and focus on use cases related to transactions and individual saving, rather than trading and speculation."

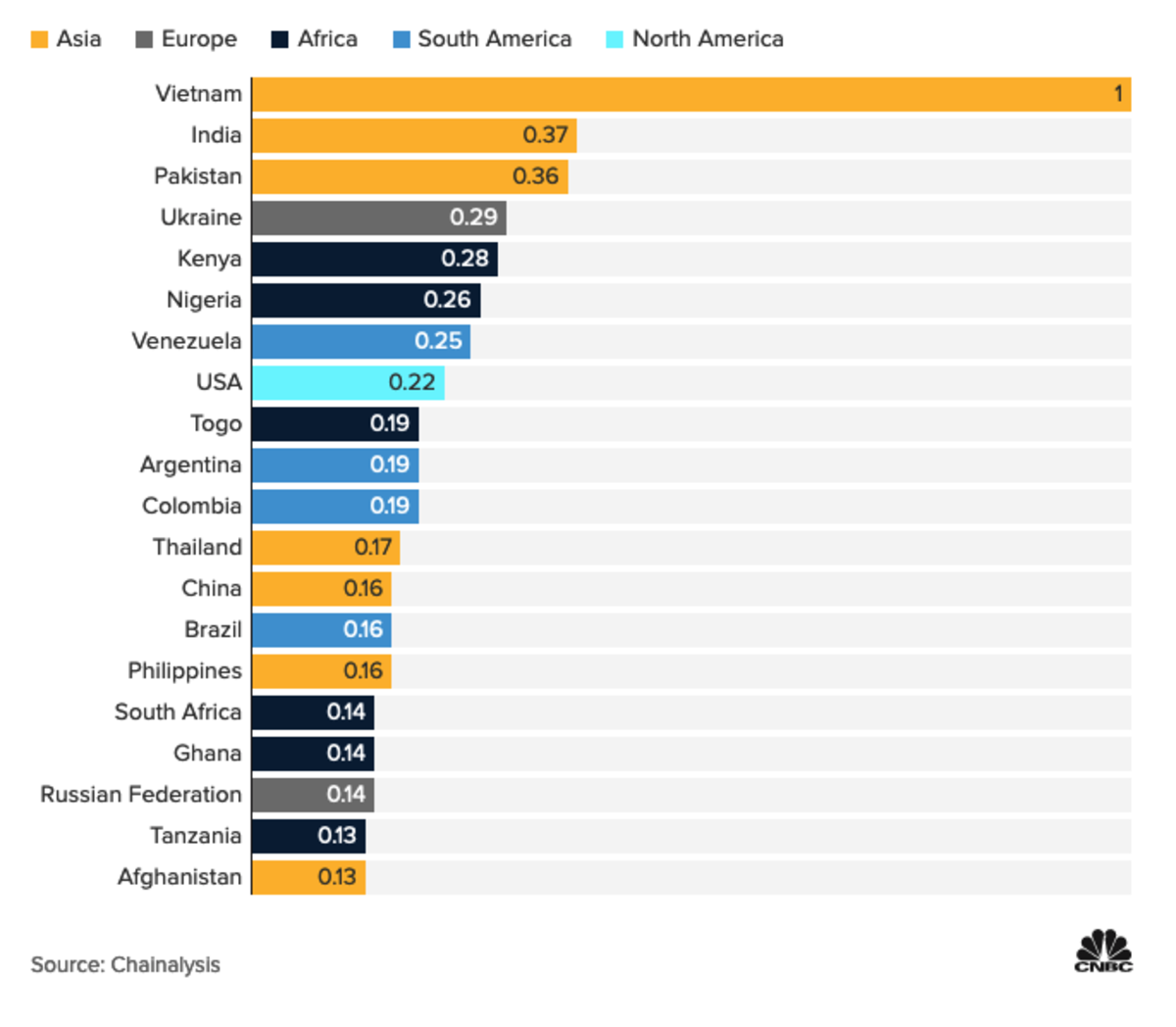

Chainalysis found Vietnam to have the highest cryptocurrency adoption, leading the 154 countries analyzed and scored on a scale of 0 to 1. Second place India scored 0.37, followed by Pakistan, with a 0.36 score.

The data analysis company uses three metrics to determine a countries score. On-chain value received, weighted by purchasing power parity (PPP) per capita, seeks to determine how significant total cryptocurrency activity volume in a country is compared to its wealth per resident.

A second metric, on-chain retail value transferred – also weighted by PPP per capita – aims to measure non-professional, individual users' activity compared to the average person's wealth.

The last metric measures peer-to-peer (P2P) exchange trade volume, weighting it by PPP per capita and the number of internet users in the country. The goal with the third metric is to try to highlight countries where more residents are putting a larger share of their wealth into