Digital Currency Group’s Flagship Grayscale Bitcoin Trust Is Trading At About 16.52% Below The Bitcoin Spot Price, Marking The Largest Discount Since Bitcoin’s May Price Decline.

- Author:

- Alex McShane[1]

- Publish date:

Digital Currency Group’s Flagship Grayscale Bitcoin Trust Is Trading At About 16.52% Below The Bitcoin Spot Price, Marking The Largest Discount Since Bitcoin’s May Price Decline.

Digital Currency Group’s flagship Grayscale Bitcoin Trust is trading at about 16.52% below the Bitcoin spot price, marking the largest discount[2] since Bitcoin’s May price decline.

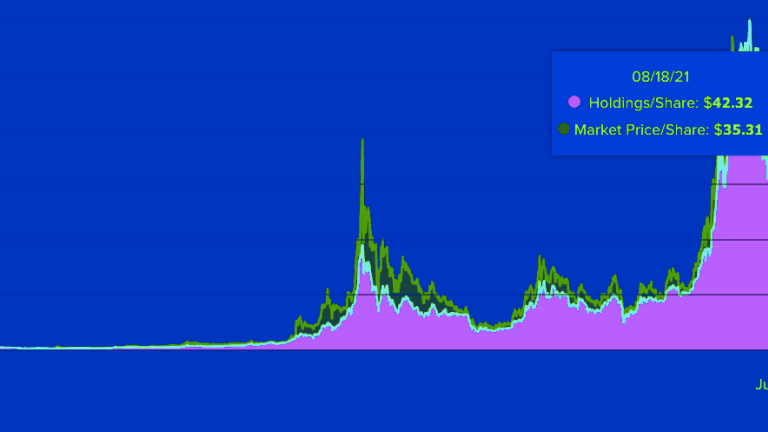

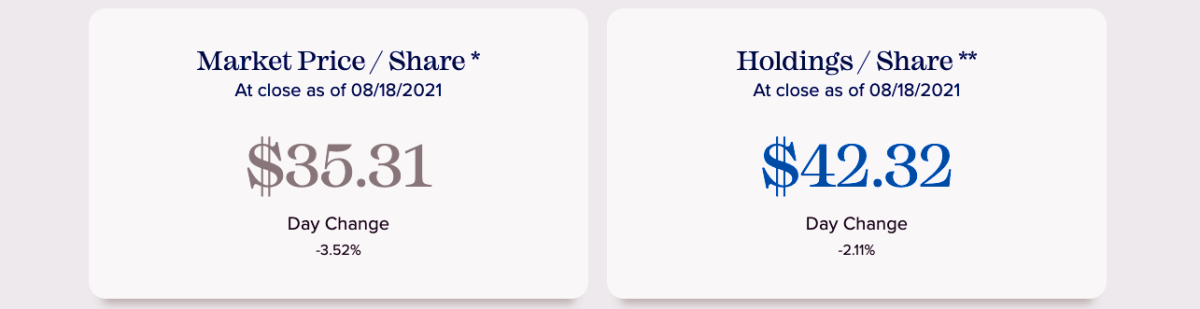

The Grayscale Bitcoin Trust currently offers[3] exposure to 0.000938223 BTC per share, an amount that trades for around $42.32 at market close on August 18. Through shares of GBTC, however, that same amount of Bitcoin trades at $35.31, a 16.52% negative spread between GBTC’s premium and underlying net asset value at time of writing.

Since May, Bitcoin has recovered up to $44,300 at the time of writing, while Grayscale has been slower to catch up. Due to the six-month lock-up of initial GBTC investments, GBTC holders are unable for some time to redeem their shares in reaction to the bitcoin market price. Thus, the product tends to trade at either a premium or a discount compared to the Bitcoin held within.

The development of a GBTC discount disrupts the popular carry trade of redeeming Grayscale shares when they hit a premium and shorting Bitcoin futures. This was a relatively risk-free strategy when GBTC was trading at a premium.

Now, with a negative premium, the incentive to redeem GBTC shares is gone.

At the moment, GBTC shares at a discount are an elegant solution and vehicle for traditional investors, or people who want to get Bitcoin price exposure through their retirement portfolio. The learning curve for