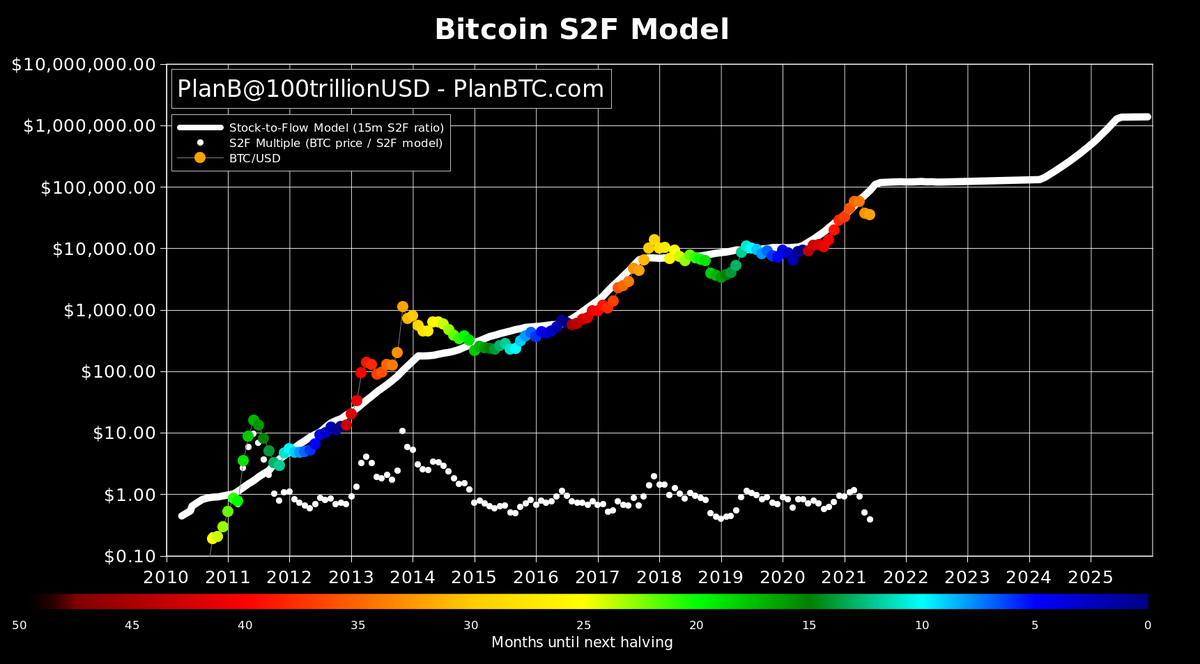

During the last week, crypto enthusiasts and traders have been discussing the stock-to-flow (S2F) bitcoin price model created by the pseudonymous crypto analyst “Plan B.” Despite Plan B’s worst and best case scenario calls on June 20, a touch over a week later the analyst said the “next 6 months will be make or break for S2F.” Currently, the S2F model has seemingly run off course and resembles the levels it saw in January 2019.

S2F Skepticism and the ‘Make or Break’ S2F Timespan

There’s some skepticism toward Plan B’s infamous stock-to-flow (S2F) bitcoin price model ever since the closing price in June recorded below the S2F’s projected course. The model’s creator, however, would not necessarily use the terms “off course” but “just touching lower bands.”

Plan B recently explained his “worst case scenario for 2021,” where he predicts prices to end up being around “Aug>47K, Sep>43K, Oct>63K, Nov>98K, Dec>135K.” However, on June 1, Plan B noted that the price was currently below the S2F trajectory.

“June closing price $35,037 .. as far below S2F model as in Jan 2019. Next 6 months will be make or break for S2F (again),” Plan B said.

My on-chain data (color overlay in the chart below) tells me this bull is not over and 64K was not the top. That is in line with s2f(x) model. Also my floor indicator (not based on s2f) says we will not go below 47k Aug close. pic.twitter.com/K6Hfjdp26x

— PlanB (@100trillionUSD) July 2, 2021

Others assume that bitcoin is just not getting attention as the media is highlighting the gains made by shiba inu (SHIB),