Bitcoin’s scalable cousin suffered badly from May’s crypto crash — is now a buying opportunity?

Bitcoin Cash (BCH) hard-forked from Bitcoin in 2017 amidst concerns over the latter’s scalability potential. It functions as a peer-to-peer digital cash which aims to become a commonly-used mode of payment for online and offline merchant transactions, across the world.

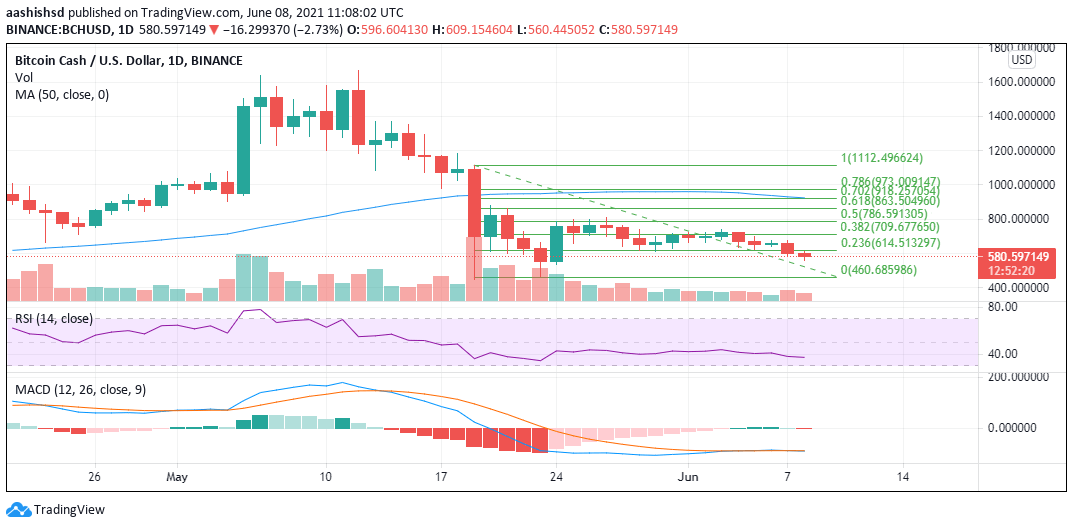

Last month’s massive crypto crash brought BCH down from a high of $1670 on May 12 to a low of $440 on May 19. At the time of writing, it is consolidating well, looking for its next rebound upwards.

Here’s a quick overview of BCH’s recent and ongoing price movements to help you make a well-informed estimation of its price by June’s end.

Bitcoin Cash Price Analysis

As mentioned earlier, BCH was trading at $584. Looking at the BCH/USD price chart, it is fairly evident that the crypto has been witnessing a constant bull-bear tug of war since May 20th, coiling into a triangular pattern, seeking its next big push.

It started the month well, looking good to break out from the Fibonacci resistance level of $786 on June 3. However, Elon Musk’s late night tweet on the same day, about having lost interest in Bitcoin, got the bears into action. Resultantly, BCH breached support near $710 and found lows of $635 and $622 on June 4 and 5 respectively. BTC and BCH, having their origins in the same blockchain and based on similar fundamentals, have a fairly strong correlation with each other. Therefore, any factor that moves the BTC price, is bound to impact BCH too, in the same way.

BCH/USD Daily Chart. Source: TradingView

BTC, as well as BCH, responded mildly to the mixed economic data emerging