In my very first foray into publishing an analysis on this topic in 2014[1], and as recently as my last piece for Bitcoin Magazine[2], I set out to contextualize Bitcoin’s energy use in comparison to that of the banking system. Since it is impossible to objectively define what the banking system (BS) is, I stuck to the mere impact of bank branches and ATMs — and the results were horrifying. This is despite the following areas of impact being ignored by my first analysis:

- All global government facilities, as the BS cannot exist without the government

- All of the world’s combined militaries, as The BS is technically backed and enforced by the world’s policing and military agencies, and not necessarily by economic fundamentals

- All other industries that support the finance sector (transport, professional services and consulting, cleaning and catering, etc.)

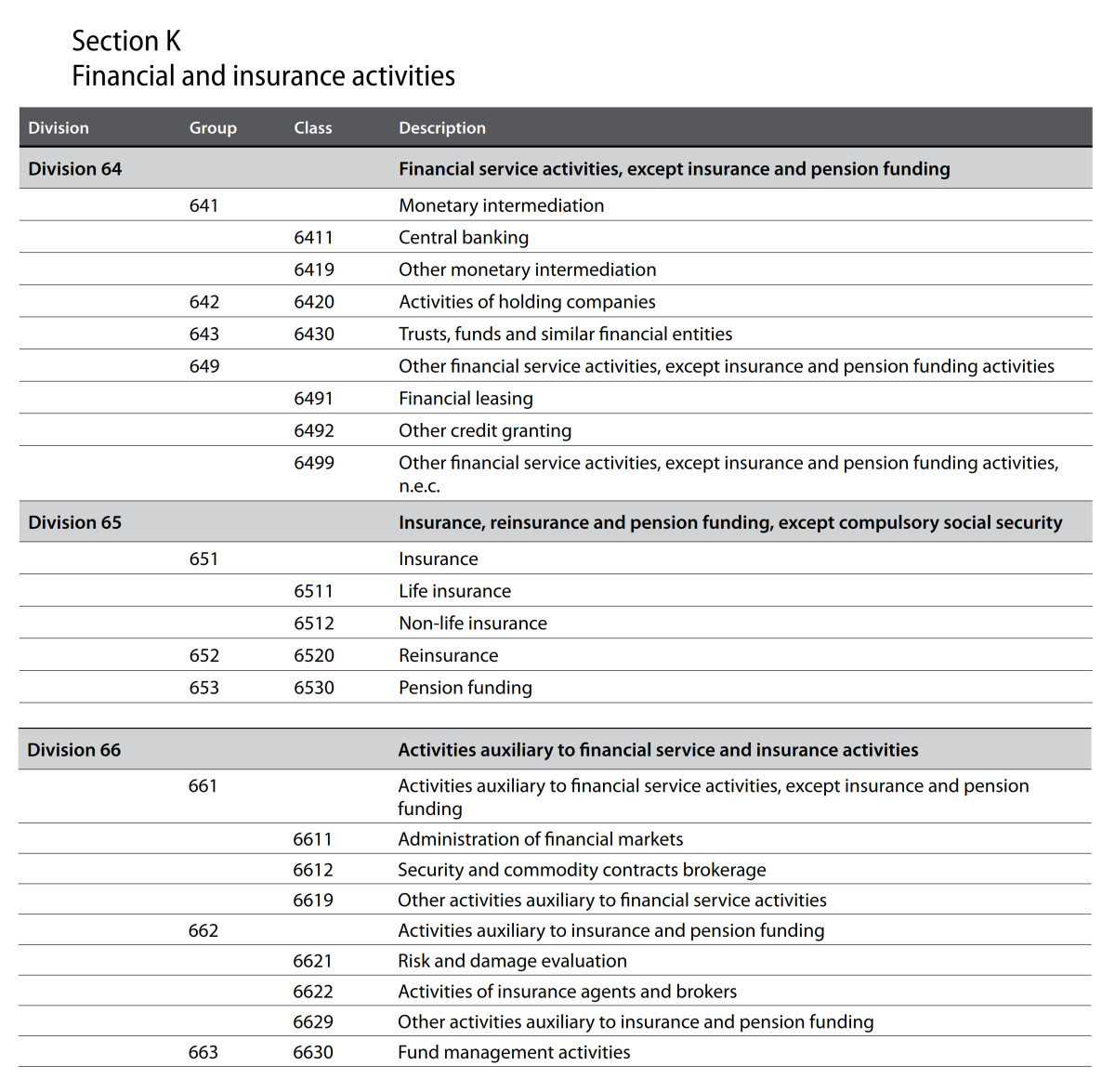

For my most recent piece for Bitcoin Magazine[3], I will admit to getting quite lazy, and merely indexing my original 2014 figures for banking by 2% per year to get to a new figure. I believe the BS, Bitcoin and the dear readers of this and earlier pieces of mine deserve better. What follows is a point-by-point update of my 2014 work on the impact of “financial and insurance activities,” as defined by The International Standard Industrial Classification (ISIC, revision four), here[4], on pages 216 to 221 (“Section K”). A summary table can be seen below.