A bitcoin price crash this week provided investors with an attractive moment to enter positions in the bitcoin market.

- Author:

- Dylan LeClair[1]

- Publish date:

A bitcoin price crash this week provided investors with an attractive moment to enter positions in the bitcoin market.

While most people reading this article are likely aware of the tweets that were sent out by Elon Musk on Bitcoin mining[2], his comments are simply noise, and the resulting price crash and derivative market liquidations provide investors who may have been waiting for an attractive moment to enter positions with a great opportunity.

The long-term trends observable in and around the Bitcoin space remain extremely bullish, and the recent three-month consolidation can be thought of as UTXOs simply transferring from weak hands to strong ones, as short-term leveraged traders in derivatives markets have chopped the price of bitcoin in the range of $44,000 to $64,000.

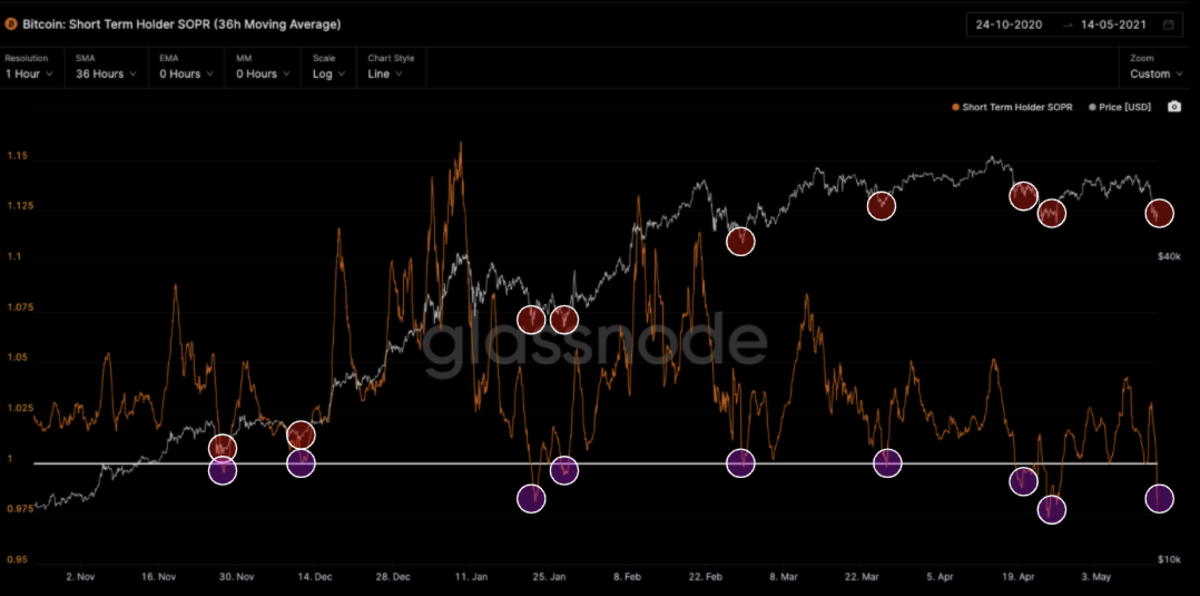

Short-Term HODLer SOPR: Flashing Buy Signal

With short-term traders setting the price at the margin over this period of consolidation, it is telling to look at short-term HODLer SOPR, which measures the ratio of profit/loss of UTXOs being spent that are less than 155 days old.

Over the course of the last six months, any SOPR break below one has, in hindsight, presented investors with an attractive buying opportunity, and this week’s move should be treated no differently.

An SOPR value less than one implies that the coins moved that day are, on average, selling at a loss (the price sold is less than the price paid), thus when SOPR breaks under one, it is a signal that short-term market actors are capitulating.

Derivatives Markets: Short-Term Tail Wagging The Dog