Mimesis Capital: Inside The Event Horizon, Report #16

Bitcoin Versus Ethereum And Other Alts

It’s been “alt season” for the past couple months. Bitcoin has remained situated around $50,000 while Dogecoin, Shiba Inu and Ethereum are soaring.

While short-sighted gamblers like to make bets on the next big dog meme coin, it’s important to review the basics of why bitcoin has accrued value and compare bitcoin to other tokens.

Bitcoin is the best monetary good.

Why? It has specific credible properties: scarce, durable, portable, transactable and so on.

From these properties, we can derive two unique characteristics:

- No counterparty risk

- No dilution risk

These two characteristics can only be maintained by having the ability to hold your own private keys and run your own full node.

No other coin or token can even compete with bitcoin on these properties and characteristics.

Therefore, no other coin or token can compete with bitcoin as being the best monetary good.

Like the invention of the number zero, “Bitcoin is a path-dependent, one-time invention; its critical breakthrough is the discovery of absolute scarcity — a monetary property never before (and never again) achievable by mankind.” — Robert Breedlove, “The Number Zero and Bitcoin”

The point of money is being able to send wealth through time and space. Bitcoin’s unique properties enable it to do that better than any other good. Since money is a winner-take-all, network effect–driven good, individuals game theoretically converge on bitcoin as a Schelling point due to its specific properties and characteristics.

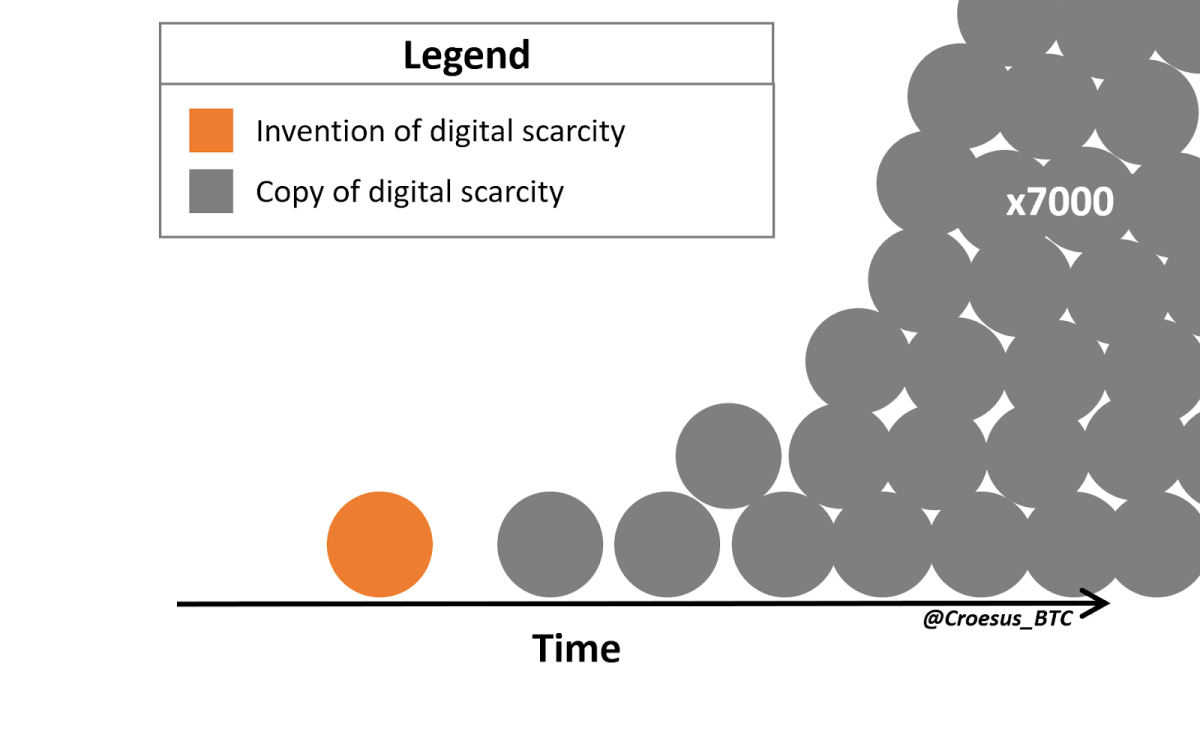

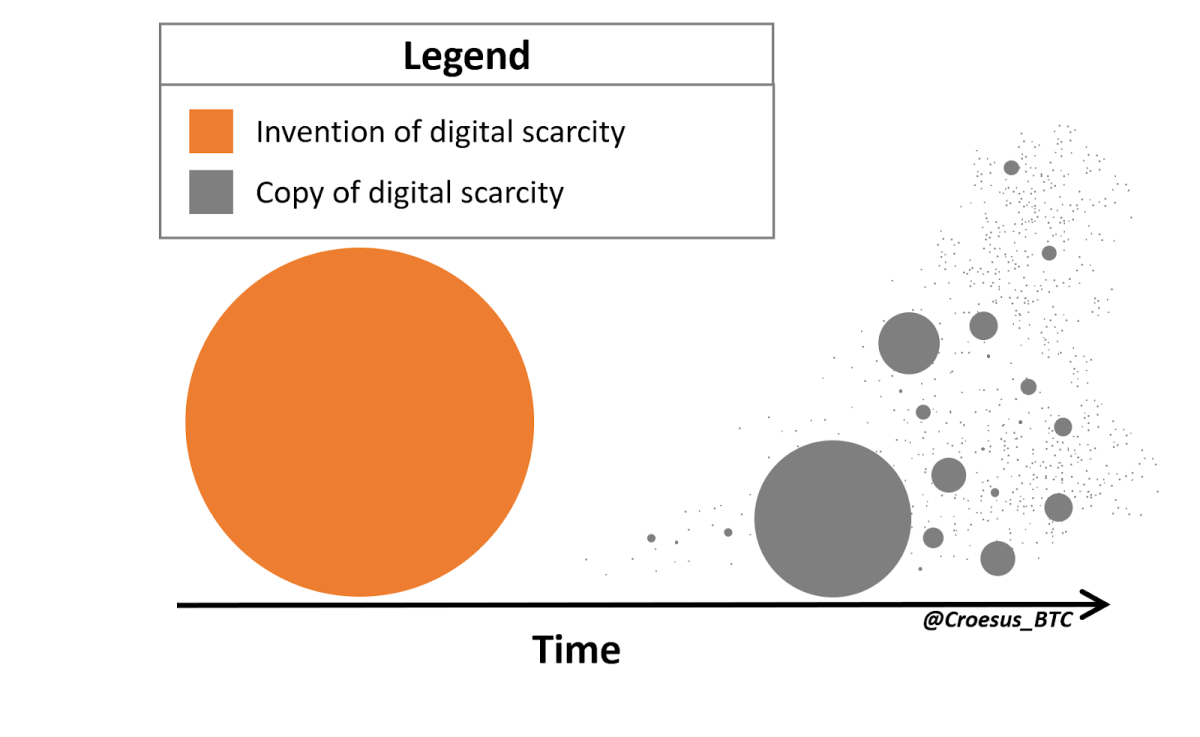

“Each digital value network carries a network effect, the strength of which can be approximated by the $ value of each. (Shown here as size of circle, with accurate scale.)

With your hard-earned money at stake, pick which circle others will value most.” —