Bitcoin has been consolidating around the $1 trillion market capitalization threshold for almost three months, which is a very healthy development during a bitcoin bull market. So, what’s happening behind the scenes, and how should investors be thinking about the recent price action of bitcoin?

Let’s dig in.

Long-Term Trend Still Clear: Bull Market Far From Over

While it is true that at the time of writing BTC is trading at a price it first saw 75 days ago, there is absolutely nothing to be concerned about in terms of the fundamentals and long-term outlook of the monetary asset. Many market spectators have been quick to call it a “top” because of the speculation occurring in the illiquid altcoin markets, but this is a shortsighted take that does not take into account the empirical data. New entrants and capital are entering the market every single day, and the fixed monetary policy of Bitcoin remains consistent.

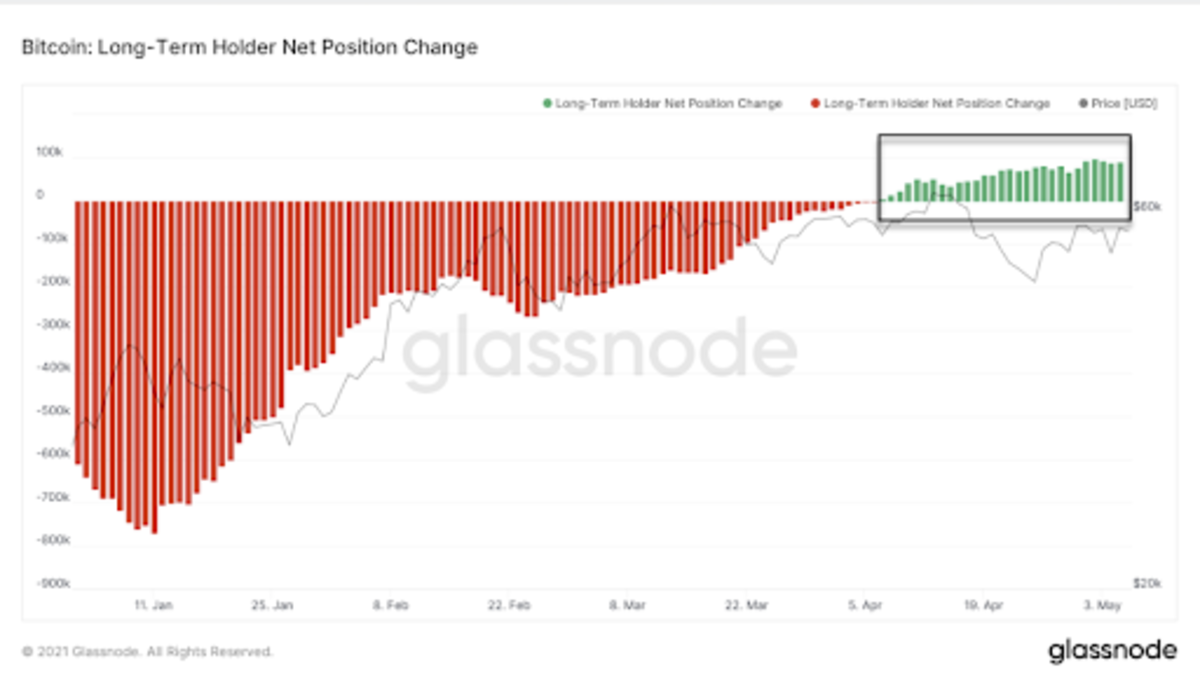

Long-Term HODLers Are Accumulating

The long-term HODLer net position change, which measures the 30-day change in supply held by long-term bitcoin holders, recently flipped positive, and the data from Glassnode shows that over the last 30 days, HODLers have accumulated 93,638 BTC more than they have sold. This shows that the conviction of bitcoiners is not the least bit shaken in regards to the choppy price action, and they are viewing the period of consolidation as a buying opportunity.

Miners Are Accumulating

Not only have long-term HODLers been net accumulating over the last month, but miners are as well. Over the last 30-day period, miners have accumulated a net position of 5,459 BTC, a bullish development as miners are the only natural sellers in the market,