Errors in the reporting of bitcoin’s on-chain data can drastically affect the volatility and price of the market.

- Author:

- William Clemente III[1]

- Publish date:

Errors in the reporting of bitcoin’s on-chain data can drastically affect the volatility and price of the market.

Bitcoin market manipulation still exists:

The importance of on-chain analytics and blockchain data providers is rising in importance right alongside bitcoin’s price and overall adoption. However, with this increase of importance comes an increase of responsibility. Tens of thousands of traders now use popular on-chain data providers such as Glassnode, CryptoQuant and Coinmetrics. These traders are making instant reactions/decisions based on this data, trying to gain an edge over others. This incentive structure to be the first to act on the data creates a dangerous precedent for the influence of bad data on the market. These actions based on bad data can have serious outcomes for bitcoin’s price. Let’s take a look at a recent example from just two weeks ago.

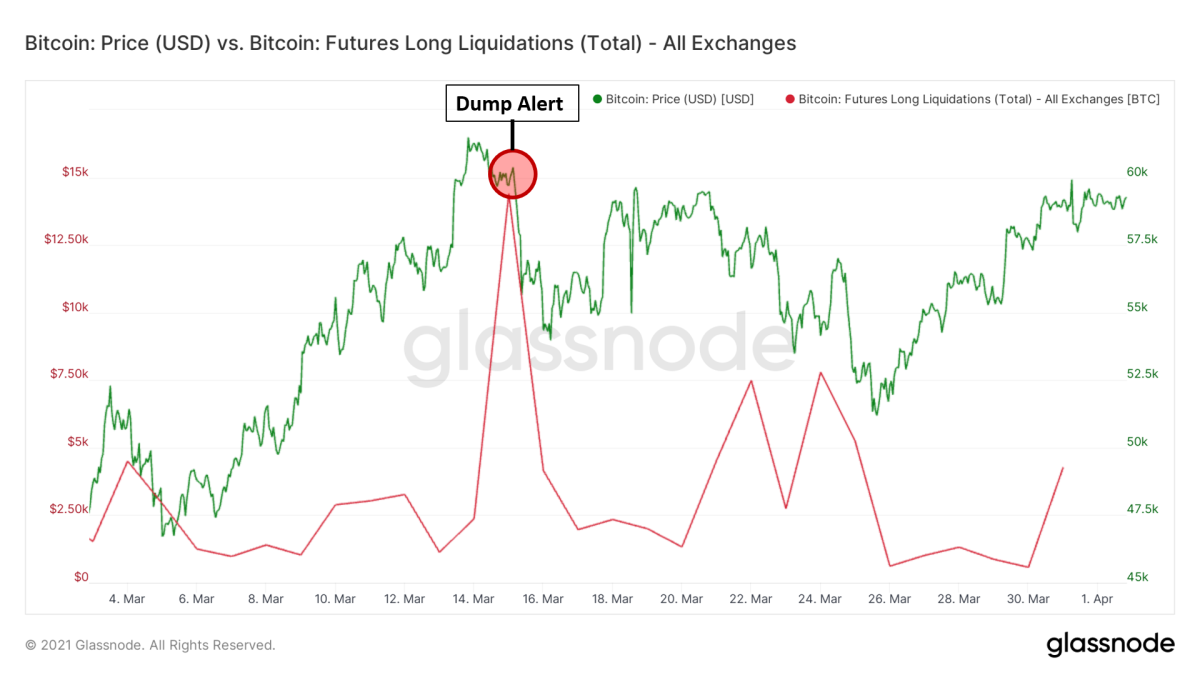

On March 14, 2021, an alert was sent out to over 28,000 traders subscribed to CryptoQuant’s telegram alert service saying $1 billion of bitcoin was transferred onto Gemini’s exchange, presumably to be sold. Within a minute, this immediately triggered a sell-off from traders, ultimately leading to a cascade of long liquidations totaling 14,396 BTC, or roughly $850,000,000. This was ultimately the catalyst for a massive drop in price and the several day consolidation that followed.

It turned out that the transfer was actually Blockfi transferring bitcoin into Gemini’s custody solution service, making the transaction actually bullish. This is a classic example of how misinformation can be the catalyst for a market dump. When funding levels go up and traders become increasingly bullish, more leverage naturally moves into the market.