Bitcoin is trading in contango. But what does this mean?

Now, what’s a futures contract?

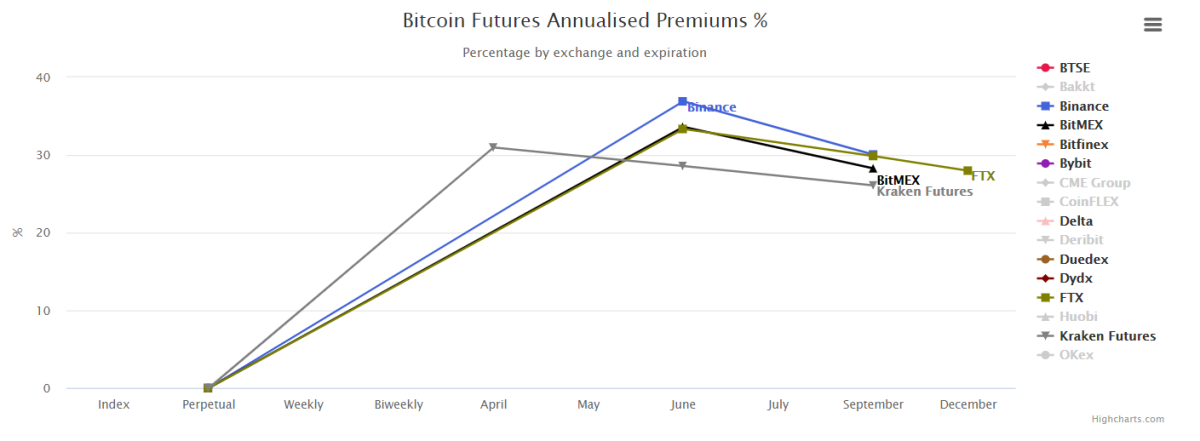

Currently, the spot price (market price for bitcoin on exchanges) trades lower than futures prices. The spread for the June futures contract is more than 25 percent annualized on most major exchanges.

This means that anyone can buy bitcoin and use that bitcoin as collateral to sell the June futures contract. This trade locks in a risk-free 6 percent USD-denominated return (more than 25 percent annualized) no matter where the price of bitcoin goes over the following months.

The only risk is exchange custody (losing coins due to poor management or hacks).

Why Does This “Free” Money Exist?

The contango exists due to how profitable it is to leverage long bitcoin (and the amount of capital willing to go leverage long versus leverage short).

Almost everyone goes leverage long on bitcoin in two ways:

- Long perpetual swaps

- Long forward futures contracts

Currently, there is $22 billion in open interest on perpetual swaps and futures[3]], so there is a significant amount of capital and liquidity.

If you go long on the perpetual swap, you are charged a funding rate every eight hours. This funding rate is set by the market to ensure the perpetual futures price stays near the index spot price. In a way, it is basically a futures contract that is only eight hours in duration and it always rolls over.

Over the last month, the perpetual swap has been