EOS (EOS) traded at lows of $3.17 after plummeting 26% as a declining BTC dragged altcoins with it

EOS plunged to lows of $3.17, retesting a price level last touched in early February when it broke above a long-term resistance line. The upside breakout had seen EOS price trade higher to reach highs of $5.60.

However, a bearish flip that began on 14 February accelerated amid this week’s price shockwave. As Bitcoin plummeted to lows of $45k from an all-time high of $58.3k, EOS followed suit with a -26% move.

Although buyers have pushed it back above $4.00 and it is now trading in the green, a bearish picture remains. If EOS doesn’t follow BTC’s bounce above $50 as seen over the past 24 hours, it could slip once more and register fresh losses towards $3.00.

EOS price technical analysis

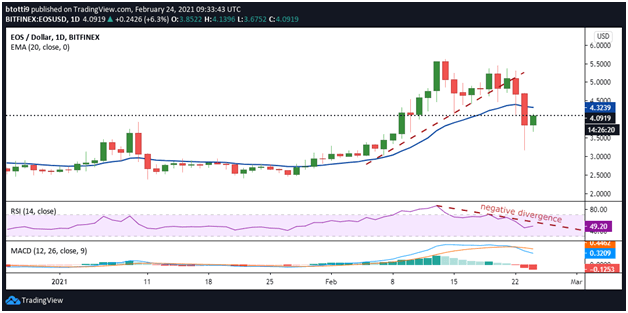

EOS price has been in a downtrend since flipping lower on 14 February. The rebound from lows of $3.17 as seen over the past few hours could aid bulls’ plans for a swift return to price levels above $5.00.

While the price is moving towards $4.10 on the daily chart, technical indicators still suggest bearish strength.

The RSI is looking to cross above the 50 line, but trends with a negative divergence suggests that sellers may yet strike again. The MACD is also within the positive zone, yet a potential bearish flip could strengthen if there’s fresh downside pressure.

Considering this scenario, EOS bulls might have to keep the upward pressure intact and bounce higher if they are to weaken sellers further. It might not be an easy task, given the considerable sell-side pressure expected at $4.32, an area currently sheltering the