The mainstream has caught a whiff of the gains cryptocurrencies like bitcoin and ethereum have seen, but many people are not aware of the passive income crypto users are getting as well. While financial incumbents are giving people with savings accounts a measly 0.35% to 0.60%, digital currencies can give people 1-17% or even more by leveraging certain tactics.

Crypto Returns That Outpace the Savings Account

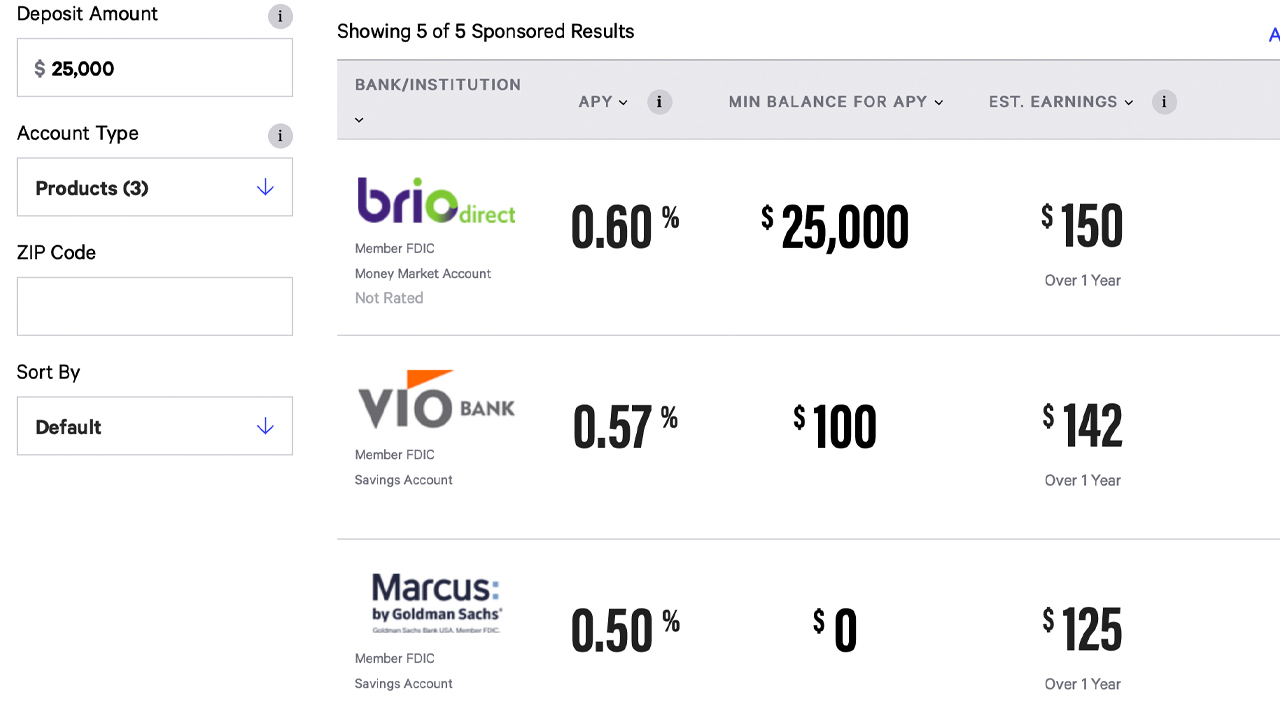

You may have heard the term “make your money work for you” in the past, and that’s what savings accounts do if they earn a percentage of interest over time. Certainly, a person can be a bit riskier and invest in stocks and such but with a savings account, the money simply sits there and accrues a return over a period of time. The more money held, the more interest an account will get but these days banks don’t like giving interest. We can see that some of the top banks in the world will only give 0.35% to 0.60% returns according to the best savings account rates on bankrate.com.

Now you can do the same thing with cryptocurrencies and get a much better annual percentage yield (APY). A lot of centralized exchanges offer anywhere between 1-12% in interest for staking or holding a digital asset on the trading platform for a period of time. For instance, on the trading platform Coinbase you can earn 1.25% APY for holding USDC. Coinbase aso offers earning rewards for staking algorand (ALGO), cosmos (ATOM), and tezos (XTZ). These three coins see payout rates either daily (ALGO), every three days (XTZ), and once a week