DOT, LTC and LINK could all correct lower before bulls resume their uptrend

Litecoin and ChainLink, like most other cryptocurrencies, have followed Bitcoin (BTC) into the red as markets react to potentially bearish comments by US Treasury Secretary nominee Janet Yellen.

The former Federal Reserve chair claimed during a Senate Finance committee hearing that cryptocurrencies were largely used in financing illicit activities.

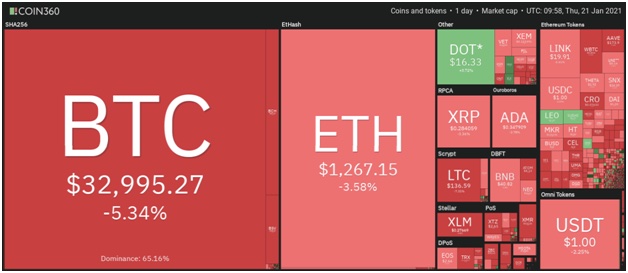

The market reaction has seen BTC price dip towards lows of $32,000 on Thursday morning. In the broader crypto market, only DOT is in the green among the top ten on CoinMarketCap.

But with further downward pressure likely before markets resume their bullish momentum, DOT and other top coins are likely to witness corrective pullbacks.

Crypto price map. Source: Coin360

DOT/USD

Polkadot faces a downward correction that could see it retreat further from its recently hit all-time high of $19.32.

The DOT/USD pair has broken below the 23.6% Fibonacci retracement level ($16.56) and tested support at the 38.2% Fibonacci retracement level at $14.77. The level acted as a strong rebound zone, with prices back above the $16.00 threshold.

If bulls push higher, Polkadot price could retest resistance at intraday highs around $18.14. The main target short term is to take out the supply wall near the $19.32 high, with potential rallies to $22.00 and then $24.00.

DOT/USD daily chart. Source: TradingView

On the flipside, sinking prices below major support at $14.77 could see bulls seek to defend gains around the 50-SMA ($12.22). The weakening MACD suggests further declines towards the psychological $10.00 and 20-SMA ($8.20).

LTC/USD

A recent break below the 20-SMA ($153) line has encouraged bears, and short term loss seems to be the most likely outcome