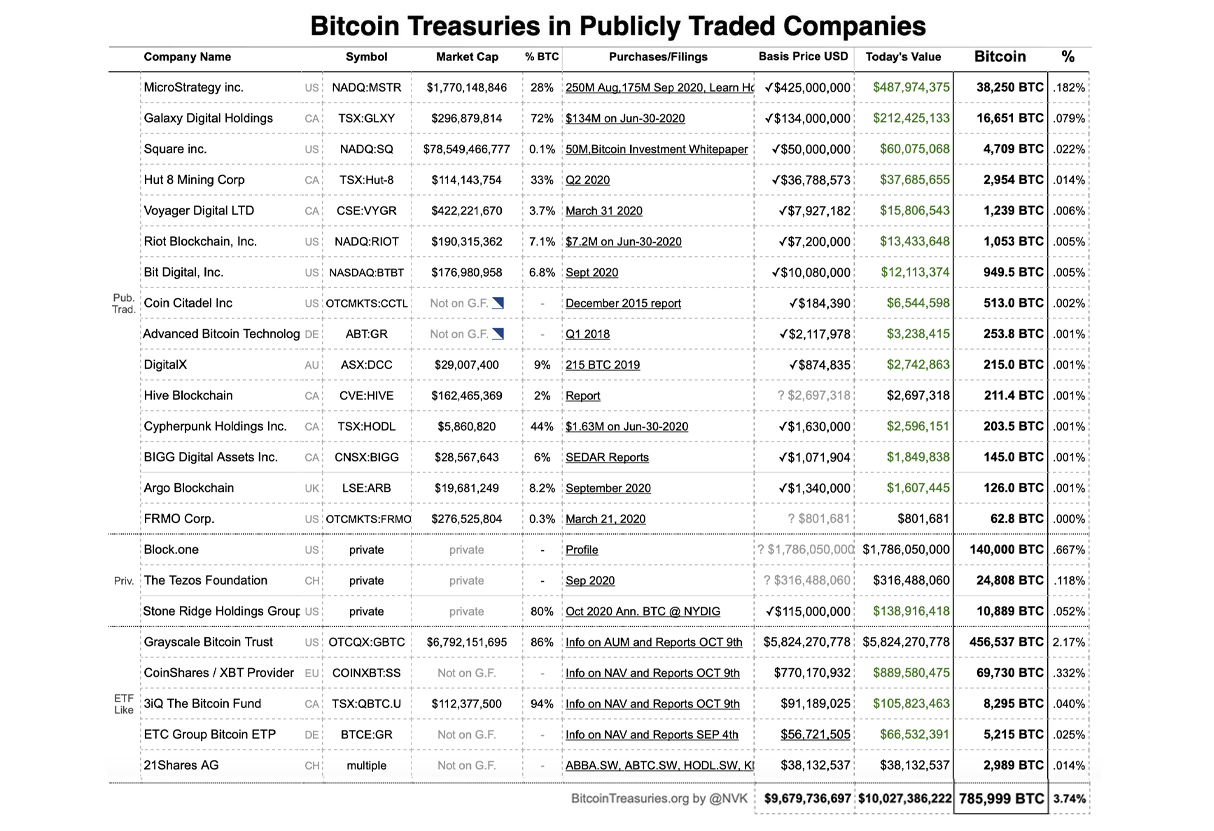

The web portal bitcointreasuries.org now shows close to two dozen firms with a large number of bitcoin reserves. Currently, the aggregate total bitcoin held in reserves by the 23 companies listed is roughly 785,999 BTC worth well over $10 billion dollars.

This past August the billion-dollar firm Microstrategy announced it purchased 21,454 BTC for around $250 million. Then the Nasdaq listed company bought another 16,796 BTC and Microstrategy raised its reserve status to 38,250 bitcoins.

Following Microstrategy’s lead during the first week of October, the firm Square Inc. revealed it purchased 4,709 bitcoins for its treasury reserves. Since these two companies made the announcements it sparked the creation of a web portal called bitcointreasuries.org, which highlights an aggregate list of companies holding bitcoin treasuries.

When news.Bitcoin.com first reported on bitcointreasuries.org there were 13 companies listed with a combined total of 598,237 BTC ($7.6B) or 2.85% of the total supply on October 10. Fast forward to today, and there’s now 23 firms represented on the bitcoin treasury list and a lot more crypto added to the equation.

The list is now broken up into three categories which include publicly listed businesses, private firms, and ETF-like organizations. 15 of the companies are public firms including Microstrategy, Square Inc., Galaxy Digital Holdings, Hive Blockchain, Coin Citadel Inc., and Argo Blockchain. These 13 public firms have an aggregate total of 67,536 BTC worth $863 million today.

Below the catalog of public companies, is a list of three private organizations including Block.one (140,000 BTC), the Tezos Foundation (24,808 BTC