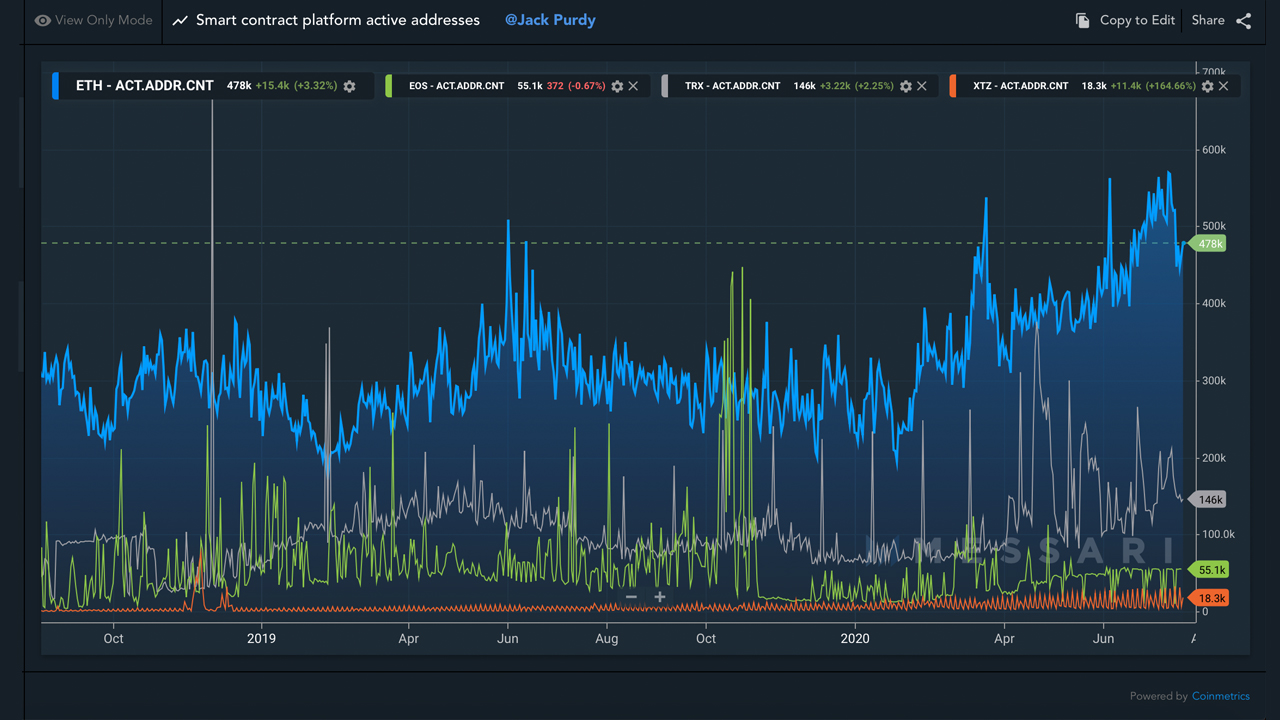

The number of active Ethereum addresses has grown aggressively in 2020 because of the decentralized finance (defi) boom. Active Ethereum addresses doubled in size leaving networks like Tron, Cardano, and EOS in the dust.

There’s a lot happening in the world of decentralized finance (defi) with things like synthetic bitcoin (WBTC), stablecoins, yield farming, decentralized exchange (dex) platforms, and more crafted on the Ethereum network. Since the end of 2019, data from Coin Metrics and Messari.io indicates that Ethereum addresses doubled in size throughout the year.

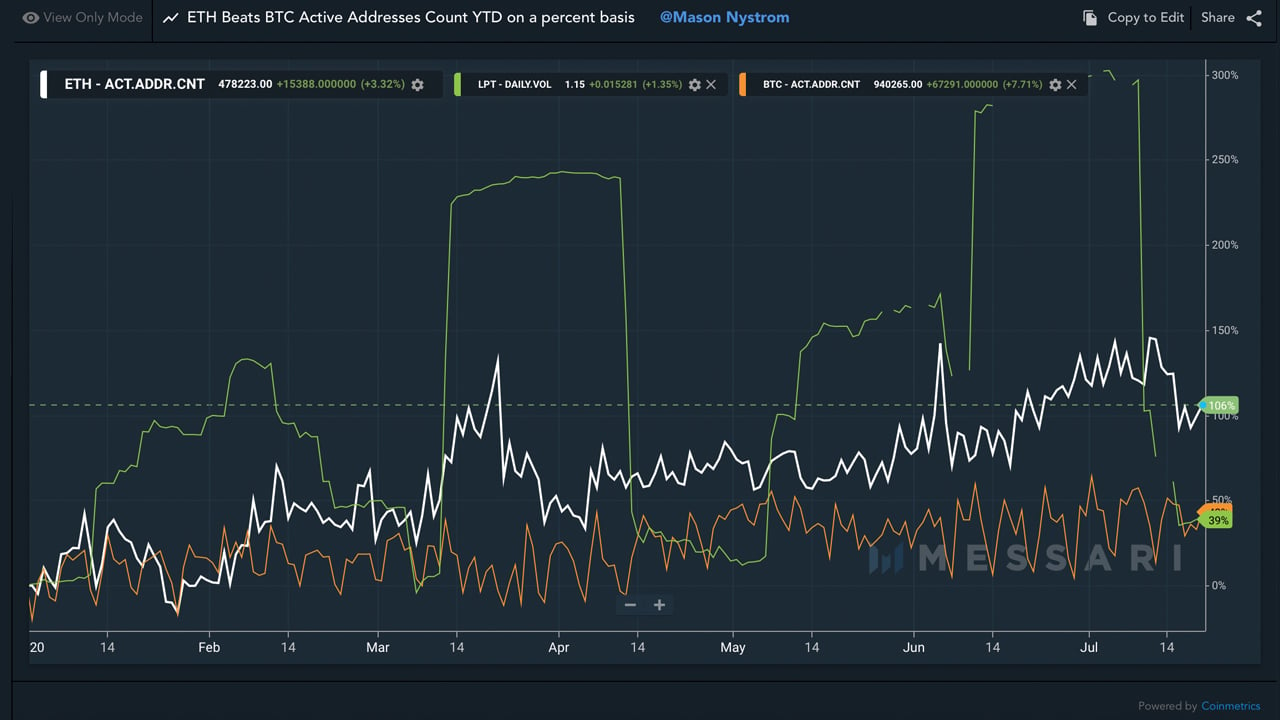

Active ETH addresses have superseded BTC active addresses by a long shot and this has been sparked by 2020’s defi bonanza. Additionally, decentralized exchange (dex) trade volumes have touched $1.6 billion this month and there were $160 million in dex swaps during the last 24 hours. The top three platforms today as far as the most exchange volume today include Curve, Balancer, and Dydx according to Dune Analytics.

Data also shows the number of ETH-based smart contract platform active addresses has outpaced other Ethereum competitors. Coins like TRX, EOS, ADA, and XTZ have been eclipsed. However, Messari researcher Wilson Withiam tweeted about the defi situation and Ethereum’s smart contract war competitors.

“In the last year, thirteen Ethereum competitors have raked in over $300 million combined,” Withiam said. “Almost all were valued well north of $100 million.”

Ethereum is also seeing a significant amount of stablecoin use between all the ERC20-based stablecoins buzzing around the network. One of the biggest ETH-based smart contracts is the most popular stablecoin in the world, tether (USDT). According to Etherscan stats, there’s a whopping 6,037,847,550 USDTs