During the last three months, the U.S. Federal Reserve has created a system of monetary avarice, as the central bank can literally do whatever it wants with zero oversight. The American public recently witnessed the Fed’s announcement on Monday, which explained the central bank will be buying individual corporate bonds on a regular basis. Moreover, the Fed’s insidious stimulus and monetary easing will not be ending any time soon. Federal Reserve Chair Jerome Powell said that America’s economic recovery requires the virus “being under control.”

The Fed Announces Individual Corporate Bond Purchases Via the Corporate Credit Facility

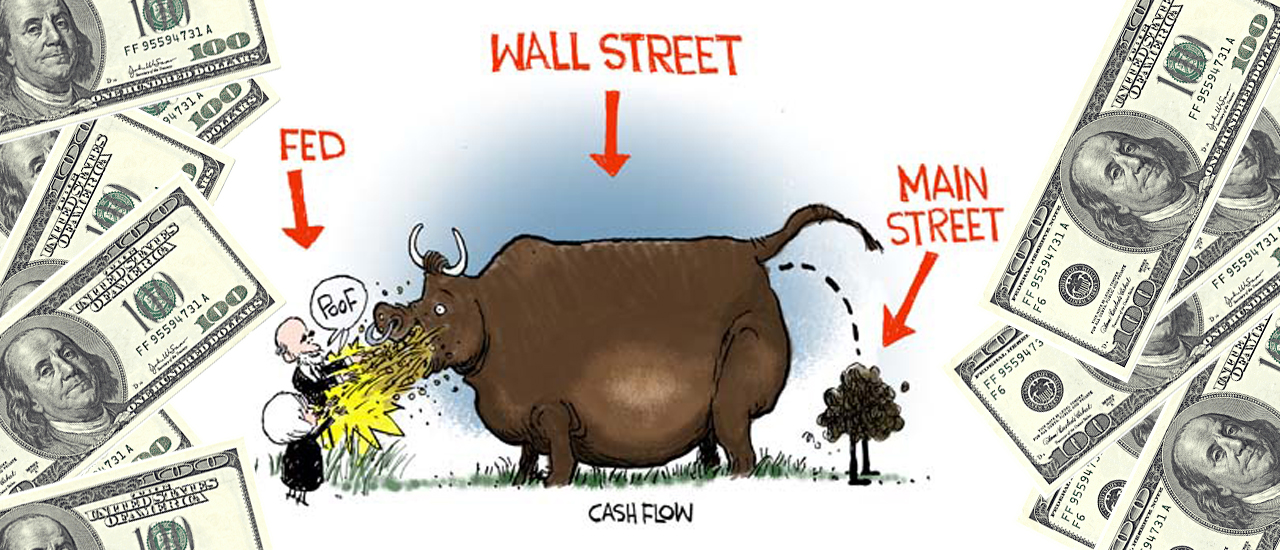

Using the coronavirus as an excuse to cunningly hide the fact that the Federal Reserve’s monetary schemes were imploding months before the first U.S. Covid-19 death, has worked out well for the central bank. After the creation of trillions of dollars that went into the hands of today’s top financial incumbents, and only a small fraction of that money distributed to American citizens and small businesses, the Fed continues its schemes.

On June 15, 2020, the U.S. central bank told the public that it would start buying individual corporate bonds. This was after the Fed had already started purchasing exchange-traded funds (ETFs). It doesn’t matter if the products being purchased are considered “junk bonds” or “junk indexes” or if the corporation made severe mistakes. The Fed has the ability to bail out any failing corporatist or any corporation on a whim.

The announcement is part of an effort that allows the Fed to make massive purchases via the Secondary Market Corporate Credit Facility. Under the new provisions, the Fed can purchase roughly $250 billion in corporate debt from eligible issuers. Additionally, the Fed has been granted the ability to siphon around $25 billion from the Treasury,