During the last two months since the March 12 crypto market rout, otherwise known as ‘Black Thursday,’ demand for cryptocurrencies seems to be on the rise in certain regions in Latin America. Various reports published this week have noted that countries like Colombia, Venezuela, Argentina, Chile, Brazil, and Mexico have seen significant bitcoin trade volumes. However, other reports show that even though the volumes are high in these specific countries, they are hard to measure due to inflation or hyperinflation.

Trade Volumes Spike in Countries Like Brazil, Mexico, Venezuela, and Argentina, But the Region’s Fiat Currencies Are Also Stricken by High Inflation

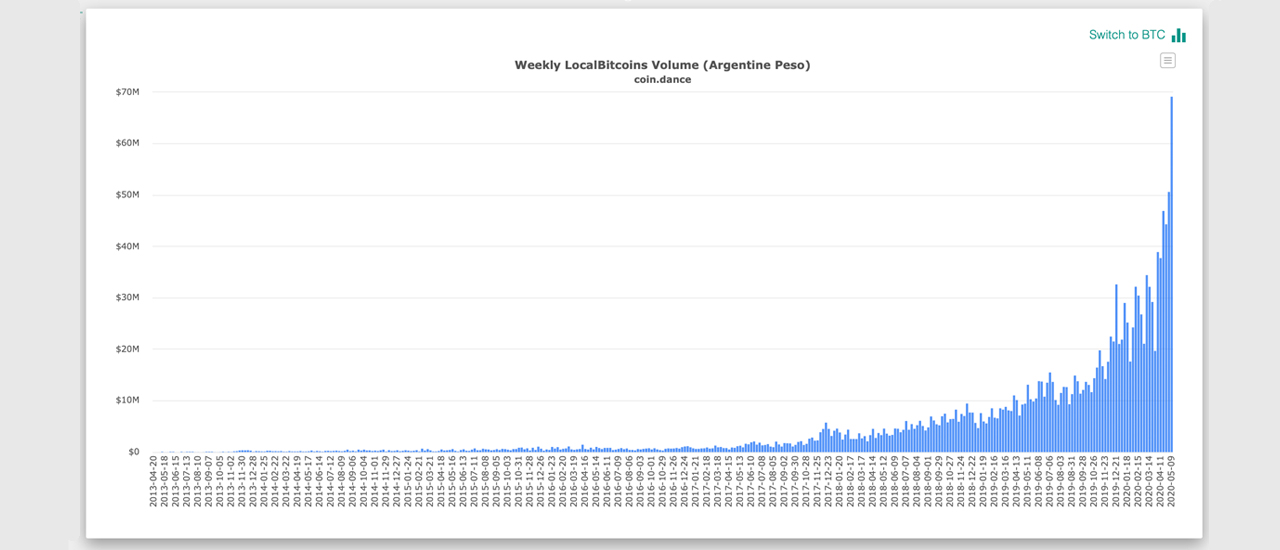

A lot of bitcoin trade volume has been taking place in a variety of Latin American countries. Peer-to-peer marketplaces that sell cryptocurrencies are seeing strong volumes in these regions. According to Coin Dance volume statistics, Colombia, Brazil, and Chile have seen significant bitcoin trade volumes on Localbitcoins week after week. Venezuela and Argentina bitcoin trade volumes indicate new all-time highs and the trend can be seen on Paxful, Mycrypto, Local.Bitcoin.com, and other platforms as well. Because of this vast crypto trade volume in Latin America, it had prompted a number of financial news outlets to report that there is significant demand stemming from these areas. For instance, Nikkei Asian Review staff writer Naoyuki Toyama recently wrote that “bitcoin shines in emerging markets plagued by falling currencies,” and “from Bueno Aires to Beirut, investors embrace cryptocurrency as a safe haven.”

Despite the reports, a few media outlets like Decrypt, Crypto Globe, and a few others showed a different side of the story. For instance, it seems people are not taking into account that the fiat currencies in these countries