As the coronavirus outbreak ravages the global economy, a number of industries are taking a bit longer to feel the brunt of the financial hardship. As individuals watch the value of their investments fall, economists believe the U.S. housing market will crash to 29-year lows amidst a looming global recession. Lendingtree’s chief economist Tendayi Kapfidze is one of those analysts who believe the U.S. might see a complete “shutdown in the housing market.” Kapfidze warns that Covid-19 fears will leave a “drastic impact” throughout the entire real estate industry.

Also read: US Cash Crisis: Withdrawal Limits Spark Bank Run Fear

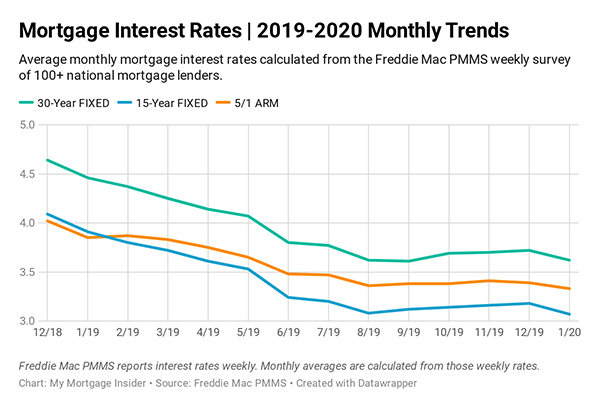

While the Fed Slashes Interest Rates and Pumps Trillions Into Banks, US Real Estate Interest Rate and Prices Remain High

Stocks, bonds, equities, commodities, and digital currencies all saw an intense sell-off during the last week and a half. Industries like airlines, tourism, hotel chains, agriculture, and construction have seen revenues slide to levels not seen in well over a decade. One industry that hasn’t been affected much yet is home prices, at least by assessment values in the real estate market where prices remain at 2019’s high levels. Searching MLS listings in the U.S., clearly indicates that home prices haven’t changed and overvalued properties are still very prevalent. Despite the Federal Reserve dropping the benchmark interest rate for private financial institutions to 0%, the 30-year fixed mortgage rate spiked 0.3% higher this month. Right now, 30-year loans from the same banks with 0% interest rates, zero reserve requirements, and a trillion dollars spoon-fed to them daily, the real estate loan rate is still set at 3.65%. Moreover, the government-owned Freddie Mac released data that shows its rates are still stuck at 4.28% this week as well.