Crypto traders in Poland have been unpleasantly surprised with a controversial tax they thought they wouldn’t have to pay. The Civil Law Transactions Tax (PCC) is applicable to digital asset trades conducted before the introduction of last year’s moratorium on its collection, the Polish tax administration recently clarified. The matter has been discussed on European level as well.

Also read: European AML Directive Pushes Crypto Startup Bottle Pay Out of Business

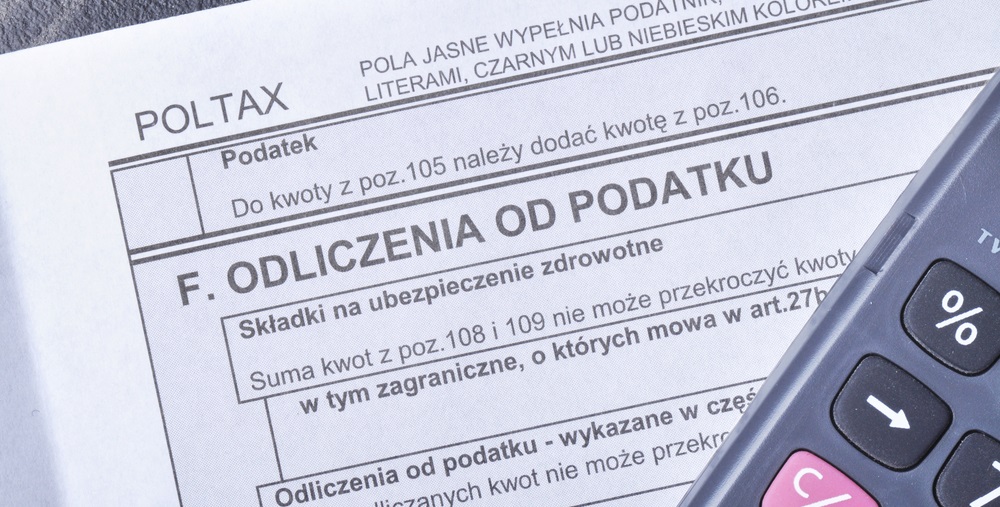

PCC Tax Applies to Crypto Transactions

In Poland, the PCC tax (Podatek od czynności cywilnoprawnych) is a 1 or 2% tax levied on sales of assets outside the scope of Europe’s widely implemented value added tax (VAT). The transfer tax on civil law transactions is usually due when the seller is not a business entity or the sale is of a movable property, real estate or various rights. The tax is payable by the buyer and is calculated on the value of the purchased asset.

According to an interpretation of the tax code issued in April last year, a 1% PCC tax should in principle apply to cryptocurrency transactions after digital coins were recognized as property rights. Following protests from the country’s crypto community and an online petition, however, the Ministry of Finance imposed a temporary hold on its collection in the summer of 2018, which was extended in July this year until June 30, 2020.

Since then, the issue has been hanging in the air, with the government in Warsaw taking time to consider its long-term policy regarding crypto taxation while also hoping for а pan-European solution. Polish media reported that the matter has been discussed during the Dec. 5 meeting of EU’s Economic and Financial Affairs Council (Ecofin). A decision on that level will