Digital currency markets have been trending downward in a triangular pattern since the 40% spike that took place on October 25. Following the three-week downtrend, cryptocurrency traders are quietly playing positions while patiently waiting for the next market signals.

Also Read: The Bank of Google Wants Your Spending Data

Crypto Markets Lose 20% Since the Late October Price Spike

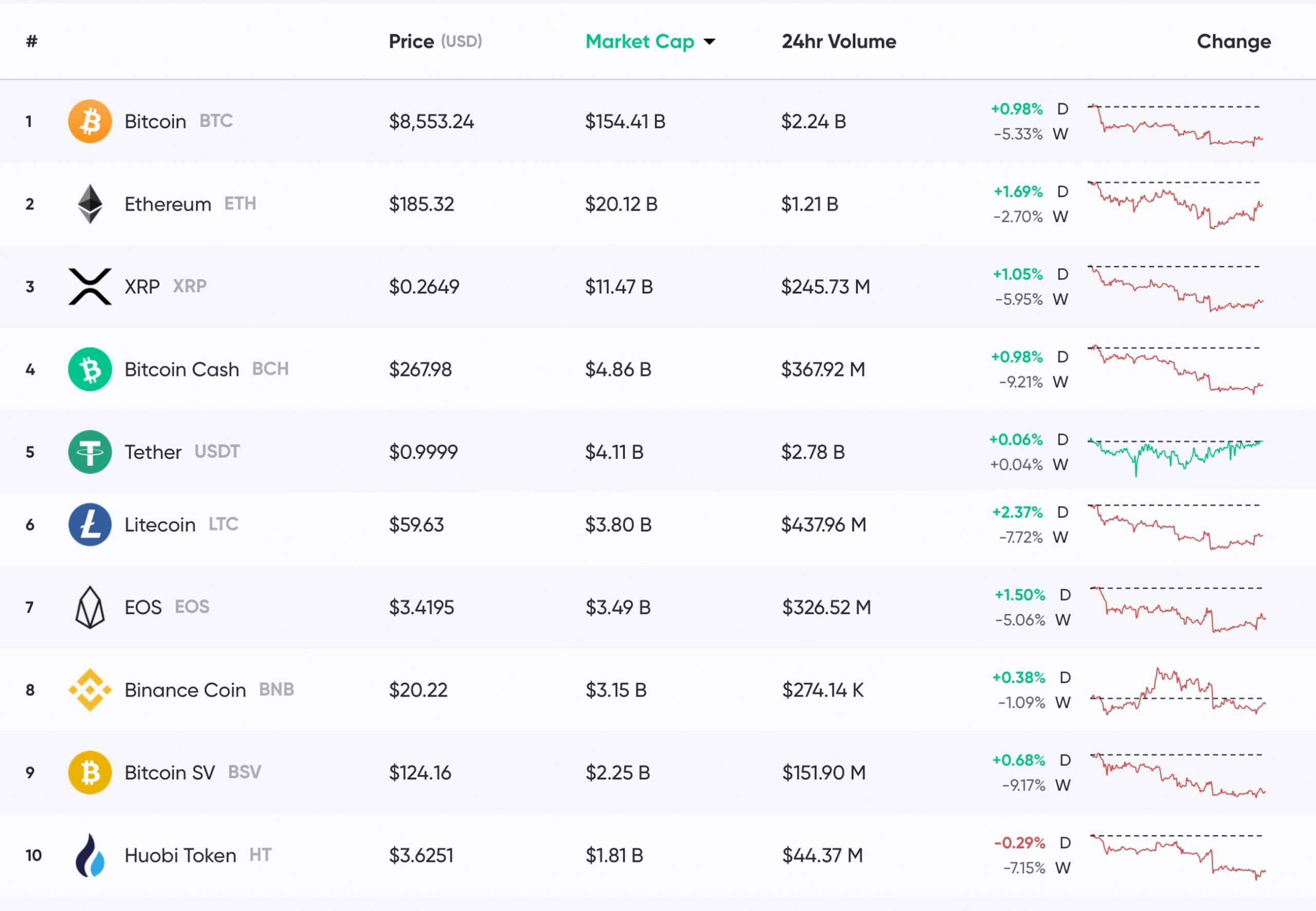

During the third week of October, BTC jumped from a low of $7,300 to a high of $10,295. Most crypto markets that day saw a 30-40% rise in value, but since then digital currency prices have slipped. BTC shaved 20% since the last high, dropping to a low of $8,355 on November 15. On Sunday, November 17, crypto prices are a touch higher than the lows on Friday as most assets are up between 0.3% to 2% in the last 24 hours. The overall market valuation for all 3,000+ digital currency markets is roughly $235 billion today. With a market cap of around $154 billion, BTC captures 65% of the cryptoconomy’s entire valuation.

Currently, BTC is swapping for $8,553 per coin and there’s a touch more than $2 billion in 24-hour volume. ETH markets are up 1.69% today as each coin is trading for $185 this Sunday. The cryptocurrency has a market valuation of about $20 billion and there’s $1.3 billion in global ETH trades today. Crypto trade volumes have been extremely slim compared to the volumes seen three weeks ago. XRP is trading for $0.26 per coin and the currency is up 1% over the last day. Lastly, tether (USDT) is the fifth-largest market valuation and the stablecoin is capturing more than two thirds of trades with