Economists have been predicting a worldwide recession which could pose a risk to financial stability throughout various countries. Fear of an economic downturn has caused the central bank of Australia to cut interests rates on Tuesday and both the U.S. Federal Reserve and the Reserve Bank of India are in the midst of discussing slashing interest rates as well. What is more frightening is the fact that smaller financial institutions are also offering negative interest rates to consumers in a predatory fashion.

Also read: Bitcoin Cash Markets and Network Gather Strong Momentum in Q1

Governments and Financial Institutions Push More Debt, Negative Interest Rates, and Trade Wars

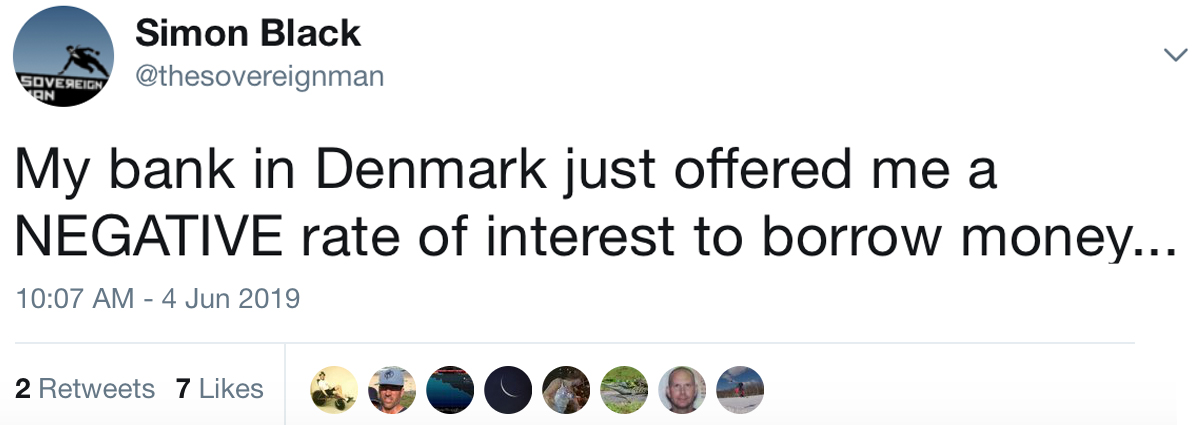

On June 4, an international contributing editor from the publication Sovereign Man discussed how he was offered a 10-year mortgage from Denmark, Nordea with a negative interest rate of minus 0.12%. The writer detailed how he once thought that this type of lending traditionally stemmed from big banking institutions but nowadays he says “negative interest rates are the norm.” “In other words, the bank would pay me to take out a loan — Thousands, if not tens of thousands of Danes will go out and take out mortgages that will pay them every month.” The Sovereign Man editorial emphasizes “how broken the financial system really is.”

“Now, institutions and governments are incentivizing people to consume, instead of save. In fact, they’re paying people to go into debt,” the editorial details.

The day before the central bank of Australia cut interests rates for the first time in three years. Interestingly, on the same day, the Reserve Bank of India’s six-member monetary policy committee (MPC) started discussing slashing rates to help curb inflation as well. In addition to India and Australia, the St Louis Federal Reserve