The Chicago Mercantile Exchange (CME Group) has seen a big spike in bitcoin futures volumes according to an internal investors email sent to clients on Feb. 19. CME Group’s note explains that last Tuesday’s BTC-based futures volumes touched a new record with 18,338 contracts traded and the firm says increased volumes may be due to gradually rising institutional interest.

Also Read: This ‘Faketoshi’ Signature Tool Lets Anyone Become Satoshi Nakamoto

Bitcoin Futures Volumes Spike in 2019

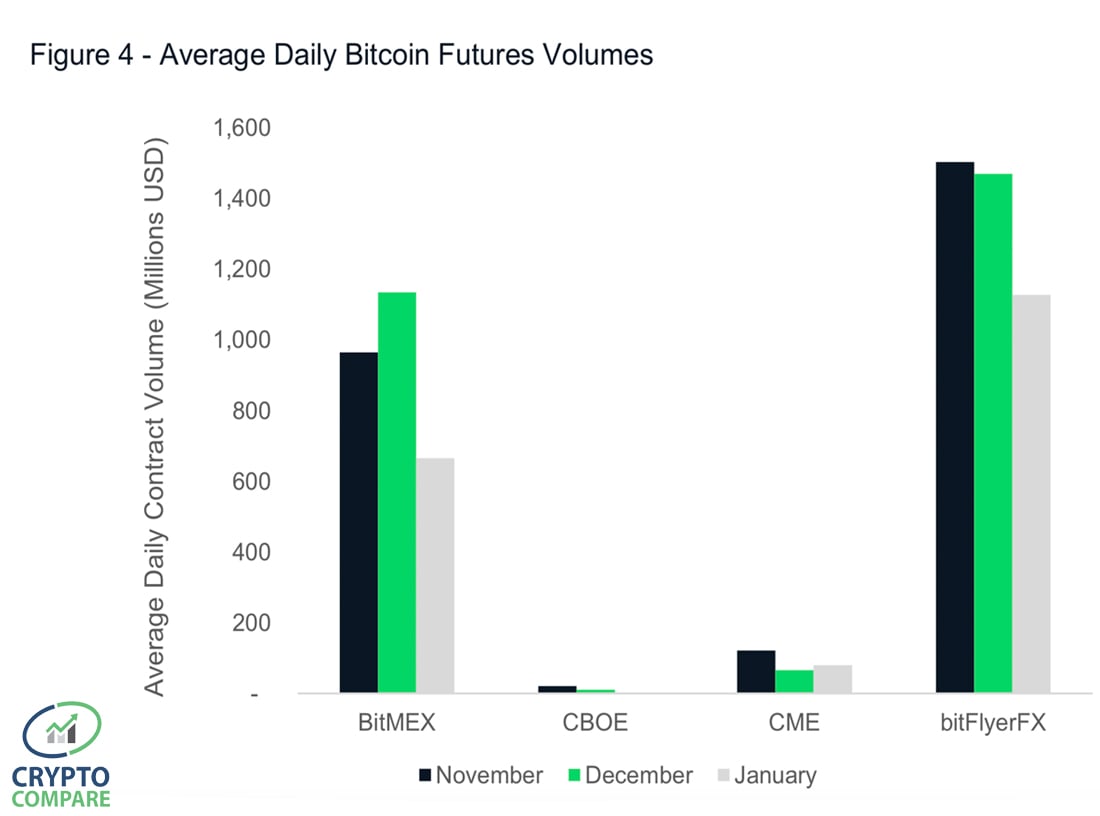

Cryptocurrency derivatives kicked into high gear in 2017 when two of the largest FX exchanges in the world, Cboe and CME Group, launched their bitcoin futures products. Initially, interest in these markets was high, but a few months later crypto derivatives volumes on these exchanges started to wane. Then in the summer of 2018, futures contracts from the two regulated exchanges began to rise again and interest in these products started to increase significantly. Last December, futures volumes were lower and spectators saw some signs of backwardation which means the derivatives predictions on the price of BTC are significantly lower than the prices on global spot exchanges. However, there was a shift in 2019 as prices returned to normalcy between both futures and spot values and volumes increased in January.

“Futures products from traditionally regulated exchanges (CME and CBOE) represented 11.7% of the Bitcoin to USD futures market in January, up from 6.36% in December,” explains Cryptocompare’s January exchange research.

Cryptocompare’s data shows that CME Group has seen more volume than Cboe in January but non-traditional futures trading platforms stole the show last month. Research reveals that Bitflyer FX traded