Cryptocurrency markets are volatile and people can make a lot of money from the up and down price variances. When digital assets touched all-time highs this past December, a great majority of digital currencies lost more than 70 percent of their value. Now some traders were able to call the top, while others ‘hodled’ in hopes of better prices in the future, and then some traders shorted the markets all the way to the bottom. There are a few exchanges that offer leveraged BTC/USD futures contracts and other margin positions that allow traders to make decent profits even when markets are extremely bearish.

Also read: Markets Update: Cryptocurrency Bulls Continue to Charge

Long and Short Cryptocurrency Positions: Making New Trading Opportunities With Leverage

When people think about trading cryptocurrencies they think about traders who make money by buying cryptocurrencies at a low entry price and selling it for higher than the original purchase price. And because digital asset values usually fluctuate, they can wait for markets to drop again and repeat the cycle. However, there are many other ways to trade virtual currencies and over the past six months of bearish crypto-markets, some people have been utilizing leverage and margin trading to turn negative market values into profitable opportunities.

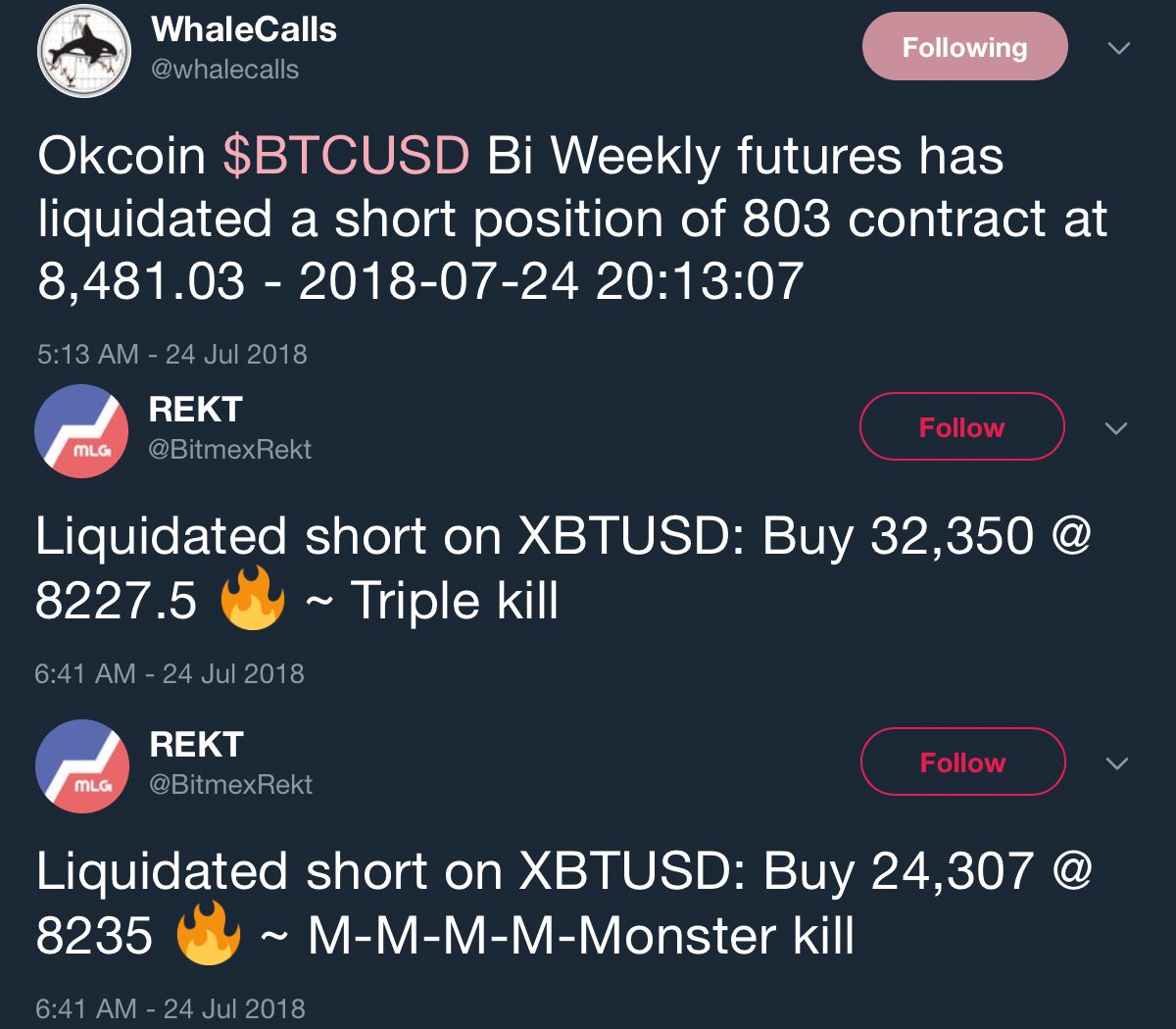

Margin trading can be risky and a lot of people get rekt along the way.

Margin trading can be risky and a lot of people get rekt along the way.

Traders using exchanges like Bitfinex, Kraken, Bitmex, and others could have shorted bitcoin this year making a lot of money if their strong convictions were timed right. Markets like the ‘Crypto Winter’ of 2018 was the perfect landscape for those who wanted to short cryptocurrencies and ride the slopes all the way down.

A list of exchanges that offer leverage trading:

A list of exchanges that offer leverage trading:

- Bitmex

- Bitfinex