In today’s edition of Bitcoin in Brief we cover the news that the world’s largest asset manager Blackrock is examining the crypto market, Coinbase is approved to list security tokens, and Bitpay got a New York Bitlicense. Additionally, the BCH exchange rate is now displayed directly on Google.

Also Read: UK Mosque Collects Four Times More Donations in Crypto Than Fiat

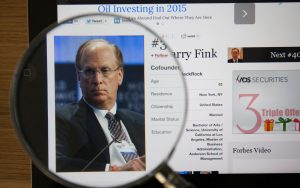

Blackrock Examining Crypto Market

Blackrock, considered to be the world’s largest asset manager with over $6 trillion in assets under management, is probing the crypto market. Reports have popped up yesterday that the NYSE-listed company has created a ‘working group’ to explore how it can take advantage of the hot new alternative investment instruments.

Blackrock, considered to be the world’s largest asset manager with over $6 trillion in assets under management, is probing the crypto market. Reports have popped up yesterday that the NYSE-listed company has created a ‘working group’ to explore how it can take advantage of the hot new alternative investment instruments.

Larry Fink, chairman and CEO, subsequently denied in an interview that the company is setting up any crypto trading capabilities or that Blackrock received demand for it from its clients. However, he did confirm that the company is studying the performance of cryptocurrencies to be prepared for the eventuality in the future. “When it becomes more legitimatized, when it has a true open nature of it that you can identify who the players are on both sides, that’s when we’ll probably look at it,” Fink said.

Coinbase Approved to List Securities

There has recently been a race among crypto companies to acquire licenses to offer securities in the US, with firms such as Coinbase, Circle and Uphold buying up regulated assets. Now the former says that the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) have approved its takeover of Keystone Capital, Venovate Marketplace and Digital Wealth, the three entities that Coinbase sought for their licenses. The next step for the company is integrating its own