Everyone knows that bitcoin and cryptocurrency prices have been on a steady decline since the last month of 2017. While digital asset spot prices have been quite volatile, bitcoin futures products provided by two of the world’s largest derivatives exchanges, Cboe and CME Group, have seen a steady increase in trade volume and more liquidity within these markets. Furthermore, Cboe is hoping to launch a bitcoin-based exchange-traded-fund (ETF) and the US Securities Exchange Commission will decide on the fate of this new product on August 10.

Also Read: Bitcoin in Brief Thursday: Crypto Phones, Spy Games, Binance CEO vs Vitalik

While Spot Prices Decline Bitcoin-Based Futures Contracts Have Been Steadily Increasing

Cryptocurrency spot prices have been in a slump over the past two quarters of 2018 but rumor on the street is institutional interest in cryptocurrency custody and regulated investment vehicles is picking up speed. Even though market sentiment has been bearish, futures contracts sold by Cboe and CME Group have increased significantly during the second quarter of 2018. Right now, on July 12, there have been 1199 contracts filled so far and products for the month of August are adding up today as well. Cboe has been selling between 2500-18,000 bitcoin futures contracts per day.

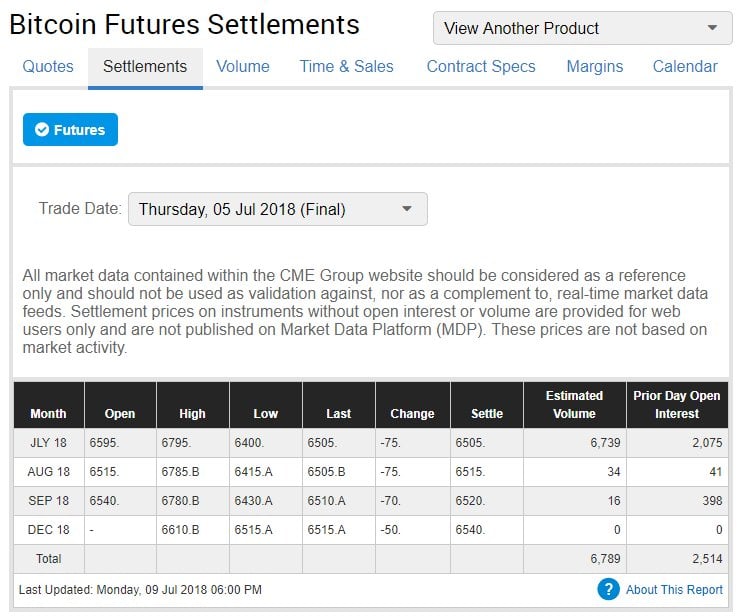

CME Group sees a spike in futures contract volumes on July 5.

CME Group sees a spike in futures contract volumes on July 5.

CME Group’s bitcoin futures volumes are usually less than Cboe’s trade volume but contracts sold on Globex have also spiked. Today CME has 2634 contracts sold for July and products for August and September are seeing a small increment of sales. CME Group’s contracts jumped to 6739 on July 5, marking a new record for CME’s bitcoin derivatives market. However, it’s still not even close to the record-setting