This past April, news.Bitcoin.com reported on the Bitcoin futures markets offered by the two derivatives giants Cboe and CME Group and how contract volumes were steadily rising. This month, while BTC-spot prices slide to significant lows, both futures products from these two companies are still seeing increased demand for contracts.

Also Read: A New Cryptocurrency Radio Broadcast Launches on Boston’s FM 104.9

Bitcoin Futures Volumes Continue to Increase

Summer is here and the month of June has been extremely bearish for cryptocurrency markets that have been struggling to grasp just a taste of those all-time highs touched late last year. The most dominant digital asset market held by Bitcoin Core (BTC) has lost over $13,000 USD in value since it touched $19,600 per BTC in mid-December 2017. Most of the crypto bull run last year took place a couple months before the launch of Cboe and CME Group’s futures markets. Immediately after these two markets went live, BTC spot prices tumbled and have been extremely bearish over the past five months since those highs. Besides the first day’s opening volumes, these derivative markets were initially pretty dull with no action and some days there were less than a few hundred contracts per day.

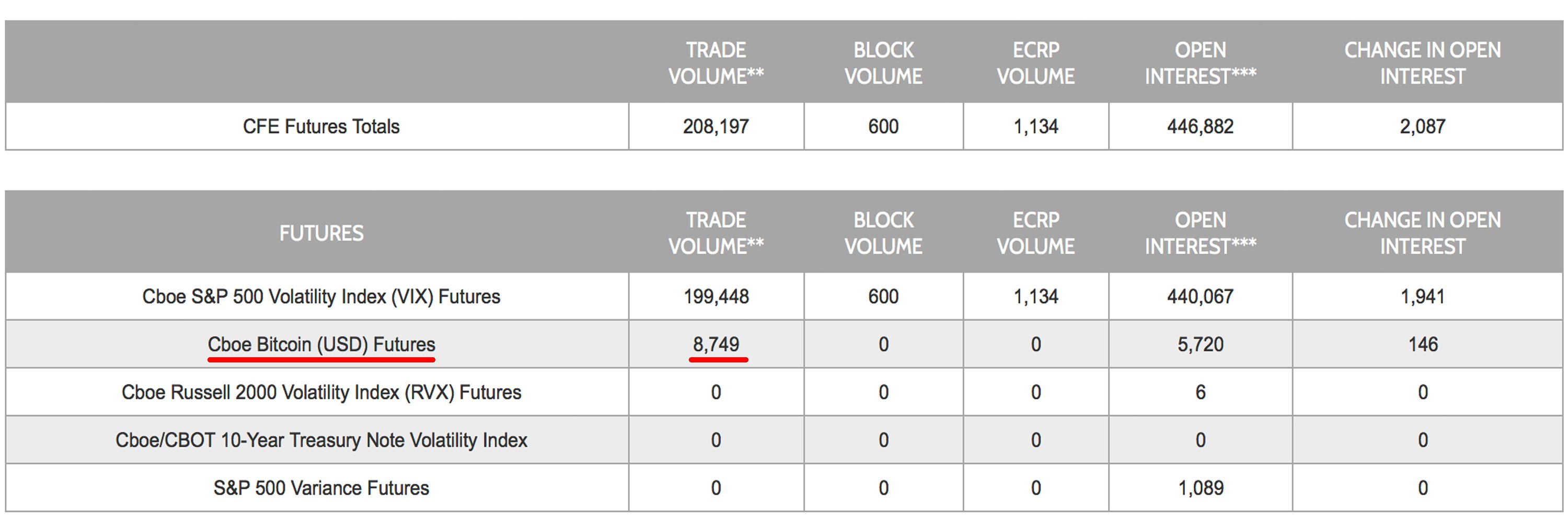

Cboe bitcoin futures volume for June 11, 2018.

Cboe bitcoin futures volume for June 11, 2018.

Things have changed since then, as we reported this past April, both marketplaces have seen increased demand for bitcoin futures contracts over the last two months. CME Group’s BTC futures on June 11, after last weekend’s ‘bloody Sunday,’ saw volumes above 3,800 contracts for June expiries, and July contracts are starting to get attention as well. The bitcoin futures forerunner, Cboe, had over 8700 contracts for June 11, which indicates the bloodier the markets are, the more