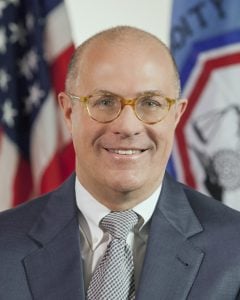

The chairman of the United States Commodity Futures Trading Commission (CFTC), Christopher Giancarlo, recently discussed the challenges associated with assessing the regulatory implications of bitcoin and cryptocurrency according to the CFTC’s “decades[-]old” legislative mandate.

Also Read: Openbazaar Co-Founder Expresses Frustration Over BTC Fees

CFTC Chairman Criticizes 1930’s Legislative Apparatus

In a recent interview with CNBC, Mr. Giancarlo acknowledges the inappropriateness of the CFTC’s antiquated regulatory apparatus when assessing the innovative phenomena of bitcoin and cryptocurrencies.

In a recent interview with CNBC, Mr. Giancarlo acknowledges the inappropriateness of the CFTC’s antiquated regulatory apparatus when assessing the innovative phenomena of bitcoin and cryptocurrencies.

When asked of the legal classification of bitcoin, Mr. Giancarlo stated: “It’s a great debate […] a lot of people are looking at it from so many different angles, and we at the CFTC have been looking at it for a number of years now.”

Mr. Giancarlo emphasized the challenge of applying the CFTC’s outdated regulatory apparatus to bitcoin, stating that “the statutes under which [the CFTC] operate[s] w[as] written, in our case, in 1935, and the SEC in 1933-34, and it’s often hard to look at those statutes, and find out where something as new and as innovative as bitcoin, and many of the other cryptocurrencies […] fall[s] into a regulatory regime that was written decades ago.”

CFTC Chairman Predicts Bitcoin’s Regulatory Challenges Won’t Be “Resolved Any Time Soon”

When queried regarding previous statements arguing that bitcoin exhibits similarities to commodities, Mr. Giancarlo stated, “I think there are certainly aspects of this that you might call a virtual asset, like gold – only its virtual […] It is an asset that many find worthy of holding for a long period of time,” adding that cryptocurrencies “have aspects […] that might not be ideal as a means of exchange, but might be suitable as a buy and hold strategy.”

When queried regarding previous statements arguing that bitcoin exhibits similarities to commodities, Mr. Giancarlo stated, “I think there are certainly aspects of this that you might call a virtual asset, like gold – only its virtual […] It is an asset that many find worthy of holding for a long period of time,” adding that cryptocurrencies “have aspects […] that might not be ideal as a means of exchange, but might be suitable as a buy and hold strategy.”

The CFTC chairman added “But the